Taking out a private mortgage generally is a enormous assist if you end up in a scenario the place you want cash, now. Nonetheless, it is usually a giant choice to make with potential penalties if not accomplished for the best causes. Now we have compiled an inventory of 9 issues to contemplate earlier than making use of.

In This Article:

- Issues to Contemplate Earlier than Making use of for a Private Mortgage

- The Finest Mortgage Comparability Platform

- What to Search for in a Lender

- Various kinds of private loans

- Typical Mortgage Software Paperwork

- Regularly requested questions (FAQs)

- Last Ideas

Issues to Contemplate Earlier than Making use of for a Private Mortgage

If you want a mortgage, it’s simple to dive headfirst into the appliance course of with out contemplating the impression it would have in your funds.

Nonetheless, when you get forward of your self, it might end in a poor choice.

Fairly than take this threat, listed below are 9 issues to consider earlier than taking out a private mortgage.

1. Your credit score rating issues extra for private loans

As an unsecured mortgage — which means there isn’t a collateral — your credit score rating performs a giant function in whether or not or not you obtain approval.

With an excellent or wonderful credit score rating, there’s a higher likelihood of discovering a lender that may give you the funds you’re looking for.

2. The rate of interest could also be greater than you count on

Lenders tackle extra threat with an unsecured mortgage, which ends up in a better rate of interest.

3. A private mortgage isn’t a long-term resolution

A private mortgage is an effective short-term resolution, corresponding to if you wish to tackle a house enchancment challenge or pay for a kid’s wedding ceremony. Nonetheless, you shouldn’t count on it to resolve any long-term monetary considerations.

4. A private mortgage might be a good way to consolidate debt

There are numerous methods to make use of a private mortgage, together with debt consolidation. This lets you carry a number of varieties of debt beneath the identical roof, thus saving you on curiosity and eliminating some stress.

5. Banks aren’t the one possibility

Whereas most conventional banks supply private loans, there are different choices. Seek for on-line banks and peer-to-peer platforms that supply the identical kind of mortgage product.

6. You is perhaps higher off with a distinct kind of mortgage

If you’ll want to borrow cash, a private mortgage isn’t your solely possibility. For instance, a house fairness mortgage — which is secured by your private home — offers you entry to the funds you want at a decrease rate of interest.

7. Private loans shouldn’t be used for sure bills

A private mortgage isn’t the best resolution for each expense. For instance, don’t take out a private mortgage to buy luxurious objects on your house, corresponding to a big-screen tv. There’s no good motive to tackle a month-to-month mortgage fee whenever you don’t must.

8. Private loans have greater month-to-month funds than bank cards

If you examine the minimal fee of a private mortgage to a bank card, you’ll quickly discover {that a} private mortgage requires far more cash to remain present.

9. Be careful for hidden charges and extras

It doesn’t matter what kind of mortgage you’re contemplating, preserve a watch out for any hidden charges and extras that would value you at inception or sooner or later.

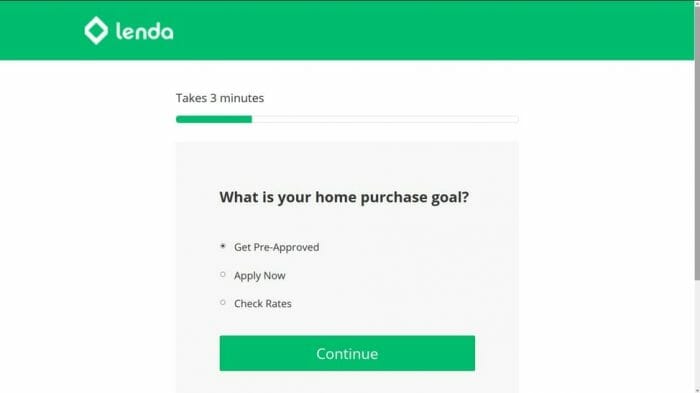

The Finest Mortgage Comparability Platform

You now have a transparent thought of the issues to know earlier than taking out a private mortgage. At this level, you’ll be able to flip your consideration to discovering the most effective lender.

Monevo is the most effective private mortgage comparability device, because it takes all of the guesswork out of the method.

The first good thing about Monevo is the power to filter outcomes by mortgage quantity, mortgage objective, and estimated credit score rating. This protects you the time of connecting with lenders that don’t match your monetary circumstances.

From there, you’ll be able to full one private mortgage software that good points you entry to a number of lenders.

You may then examine every private mortgage supplier based mostly on what they provide, shopper opinions, and different key particulars.

If you wish to discover the right private mortgage lender — and also you most likely do — Monevo can handle your complete course of for you.

What to Search for in a Lender

There are numerous issues to contemplate earlier than taking out a private mortgage, however nothing is extra vital than discovering the best lender.

Right here’s what you must search for:

Expertise and credibility

An skilled and credible lender with constructive opinions is one which you must strongly take into account. You don’t need to take a threat with such a giant choice.

Rates of interest

Your private mortgage rate of interest will vastly impression your month-to-month mortgage fee. Conserving your mortgage repayments to a minimal begins with securing the bottom doable rate of interest.

Reimbursement flexibility

What reimbursement interval are you most all for? Does the lender supply flexibility in its phrases?

Response instances

When you full the mortgage software course of, it’s your hope that you simply obtain a ultimate reply within the rapid future. Any response time over 48 hours ought to have you ever contemplating different choices.

Customer support

Private mortgage procuring is filled with twists and turns. A devoted customer support workforce will put your thoughts comfortable.

Various kinds of private loans

There are two distinct varieties of private loans:

- Unsecured mortgage: That is the most typical kind. An unsecured mortgage signifies that you don’t must put up collateral.

- Secured mortgage: A secured mortgage permits you to put up collateral, which is much less dangerous for the lender. This may end up in a decrease mortgage rate of interest.

Earlier than you full a private mortgage software, examine the professionals and cons of each varieties to make sure that you go down the best path.

Typical Mortgage Software Paperwork

The private mortgage software course of is filled with paperwork. Because of this, you need to get all of the required paperwork in place upfront. These usually embody:

Proof of identification

You must show that you’re who you say you’re. Ask your lender what kind of proof is appropriate. Typically, a driver’s license is greater than sufficient.

Employer and earnings verification

Your lender desires to know that you’ve a gentle earnings. Confirm your employer and earnings with a latest pay stub.

Proof of handle

There are numerous methods to supply proof of handle, corresponding to a latest utility invoice or financial institution assertion.

Word: your lender can give you an inventory of paperwork they settle for.

Regularly requested questions (FAQs)

With the above info, you will have many issues to contemplate earlier than taking out a private mortgage.

Nonetheless, all of those particulars are more likely to end in a handful of questions. Listed here are a number of the most regularly requested questions pertaining to non-public loans.

What is an effective credit score rating?

Experian defines an excellent credit score rating as 700 or above.

How do private loans work?

Upon receiving approval, you’ll assessment the phrases and situations and determine if you wish to settle for the funds. From there, the lender will wire the funds to your checking account.

What’s a secured mortgage?

A secured mortgage is one which’s secured by collateral, corresponding to your private home.

What’s an unsecured mortgage?

An unsecured mortgage doesn’t require collateral. That is the most typical kind of non-public mortgage.

Do private loans impression your credit score rating?

Your credit score rating is likely one of the most vital elements of your private funds. A private mortgage will impression your credit score rating. So long as you pay in full and on time, it might enhance your rating.

How a lot can I borrow for a private mortgage?

This is determined by every part from the non-public mortgage supplier to your monetary scenario.

For instance, one private mortgage lender could give you a mortgage of $25k based mostly in your present earnings. Conversely, one other private mortgage lender could solely give you $20k.

For this reason it’s so vital to buy round.

Do mortgage firms verify your checking account?

Sure, lenders usually take a look at your financial institution statements to achieve a greater total really feel on your private funds.

Do private mortgage lenders contact your employer?

This varies from lender to lender. Some will confirm your employment by contacting your lender. Others will accomplish that by way of the submission of paperwork, corresponding to a pay stub.

Both means, they’re doing so to make sure that you earn sufficient earnings to make your month-to-month mortgage fee.

Do you’ll want to give a motive for a private mortgage?

Your lender could ask you ways you intend on utilizing the cash, however you’re not required to provide them a definitive reply.

General, the element that issues most to the lender is which you could handle the mortgage reimbursement.

What’s one of the best ways to discover a private mortgage?

The private mortgage comparability course of varies from one borrower to the following. In right now’s world, the web permits you to discover and examine lenders in a quick and environment friendly method. Private mortgage procuring can take a while, so don’t rush by way of the method.

Last Ideas

This can be a lengthy checklist of the various issues to know earlier than taking out a private mortgage. Ought to every other particulars come to thoughts — corresponding to questions round which reimbursement interval is greatest for you — handle them earlier than signing your identify on the dotted line.

A private mortgage is a giant monetary choice, so examine the small print, professionals, and cons earlier than you do the rest.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.