Should you’ve ever utilized for a mortgage prior to now, and also you’ve been overwhelmed by the size of time the method takes, and the unbelievable quantity of documentation required, it is best to try Lenda. It’s an all on-line mortgage lender, that means that you can full the mortgage utility course of in a matter of minutes, and submit essential documentation with the push of a button. It’s an actual alternative to streamline the in any other case cumbersome mortgage course of.

In This Article:

- What’s Lenda?

- How Lenda Works

- Lenda Options and Advantages

- The Lenda Utility Course of

- What Separates Lenda from the Competitors?

- Lenda Professionals & Cons

- Ought to You Get Your Mortgage with Lenda?

What’s Lenda?

Lenda is a web based mortgage service devoted to streamlining the applying course of, and to offering inexpensive residence financing. Launched in 2014, the corporate’s mission is to Reimagine Homeownership. By that they imply the mortgage course of must be fast, clear, and ship financing on the lowest doable worth.

Like so many on-line platforms, Lenda makes an attempt to enhance on the mortgage utility course of by automating it via expertise. It allows you to get price quotes instantly, then to guage your utility must you determine to proceed. What’s extra, the emphasis on expertise eliminates a lot of the paperwork burden generally related to the mortgage utility course of.

However Lenda isn’t 100% expertise. You’re additionally assigned a devoted Residence Mortgage Advisor who helps you all through the method. Heavy emphasis on expertise–and away from buildings and employees–allow Lenda to decrease prices related to making use of for a mortgage. However they nonetheless make human help obtainable everytime you want it.

Lenda operates within the following states: Arizona, California, Colorado, Florida, Georgia, Illinois, Michigan, Oregon, Pennsylvania, Texas, Virginia, and Washington. Additionally they point out they’re trying to broaden into different states.

Your State is on The Checklist? Evaluate Mortgage Provides With Lenda Now

How Lenda Works

Eligible Debtors

Lenda can accommodate salaried debtors, the self-employed, and those that personal a number of properties (as much as six properties).

Property Sorts Financed

Lenda has mortgages obtainable for each residential purchases and refinances. They will additionally present financing for funding properties. Nevertheless, they don’t present financing for industrial properties, or for manufactured or cell houses.

Obtainable Mortgage Sorts

Typical loans (via Fannie Mae and Freddie Mac), however not adjustable-rate mortgages, or secondary financing (second mortgages or residence fairness traces of credit score). Lenda additionally doesn’t provide FHA or VA loans.

Mortgage phrases obtainable are 15 years and 30 years, each fastened price mortgages. Money out refinances can be found as both price and time period, or cash-out mortgages.

You’ll be able to apply for both a pre-qualification or a preapproval. A pre-qualification is the place the lender confirms your mortgage eligibility primarily based on self-reported info on credit score, belongings, and earnings. A preapproval is a a lot stronger consequence. That’s the place you provide the documentation wanted to assist the mortgage determination. Naturally, a pre-approval is far nearer to a closing approval than a prequalification.

Lenda claims it normally takes 30 days or much less to finish the mortgage course of for both a purchase order or refinance. Nevertheless, they’ll accommodate shorter time frames for those who make a request.

Mortgage Servicing

Lenda funds and closes your mortgage, nonetheless, they don’t service mortgages. You’ll be notified who and the place to make your month-to-month mortgage funds to after the closing. It is a typical apply within the mortgage business; a mortgage originated by one firm is serviced by one other. And throughout the time period of your mortgage, it’s probably the servicing will likely be transferred a number of instances.

Lenda Options and Advantages

Lenda offers all of the instruments it is advisable to get the mortgage you need.

How Do Mortgages Work Tutorial

The Lenda web site gives this program as “The Important Residence Mortgage Information to Get a Residence Mortgage for First-Time Consumers”. Should you’ve by no means bought a house earlier than, the information will stroll you thru the method. It’s a multistep course of that can assist you:

- Select a mortgage and apply for a mortgage.

- Understanding the house inspection and locking your rate of interest.

- The appraisal and insurance coverage for the brand new residence.

- The closing course of.

The information will stroll you thru your complete course of, serving to you to understand how a lot home you possibly can afford to purchase, in addition to the documentation required for the mortgage utility course of.

Lenda Refinance Calculator

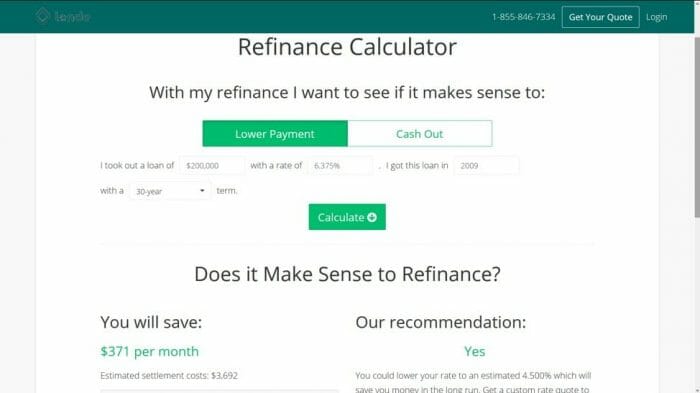

The choice to refinance your property could be a sophisticated one. That is significantly true if the distinction between your present rate of interest and a brand new one is comparatively small. It’s essential to think about not solely the financial savings in your month-to-month fee, but additionally the closing prices on the brand new mortgage, and the way lengthy it would take to get better these prices.

The Lenda Refinance Calculator will help you reply all these questions. It’ll inform you precisely how a lot you’ll save in your month-to-month fee, primarily based on present rates of interest, in addition to the closing prices concerned within the transaction. You’ll get a direct suggestion as as to whether or not it is best to proceed with the refinance.

Buyer Service

You’ll be able to contact Lenda by telephone, e mail, textual content, or on-line chat. Customer support is out there Monday via Friday, 9:00 AM to five:00 PM, Pacific time.

Lenda Safety

Lenda makes use of a multilayered safety system to guard your info. At their services, they’ve safety guards, constructing entry badges, and a video surveillance system to guard the computing infrastructure from unauthorized entry. They use administrative safeguards like safety coaching packages and worker background checks.

The transmission of data is protected by business customary encryption and the usage of Safe Socket Layer (SSL) expertise to create encrypted connections between net browsers and in-house servers. Lenda additionally implements a session timeout after 45 minutes of inactivity on their web site.

Lenda Pricing and Charges

There isn’t a utility price required, nor should you pay to your credit score report. You have to to pay an appraisal price, however that received’t be required till you’re nicely into the applying course of. The appraisal price is nonrefundable, as soon as the appraisal has been ordered and accomplished.

Rates of interest are in line with the each day pricing ranges offered by Fannie Mae and Freddie Mac for all lenders.

Curiosity Charge Buydowns

Lenda provides you the chance to decrease your rate of interest by paying low cost factors. Every level equals 1% of your mortgage quantity, and can usually decrease your rate of interest by 1/8 of a degree (.125%). For instance, paying 2 low cost factors will decrease your rate of interest from 4.5% to 4.25%.

It’s an costly strategy to decrease your rate of interest, however it could be price doing if a 3rd get together will likely be paying the low cost factors. This may be the property vendor, your employer, or perhaps a reward from a relative.

Lenda Credit score

Should you refer household, buddies or colleagues to Lenda, you’ll be eligible to obtain a $500 Lenda Credit score. It is a credit score that can used towards your personal charges along with your Lenda mortgage utility.

The Lenda Utility Course of

Give It a Attempt Now: Evaluate Customised Mortgage Provides With Lenda

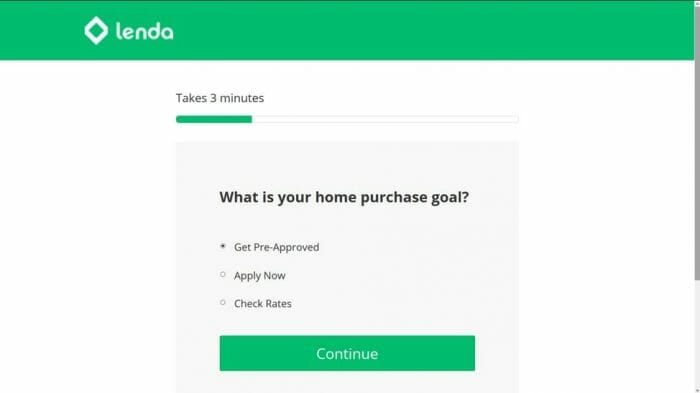

The Lenda utility course of takes place completely on-line. You’ll be able to full the applying in just some minutes. It begins with getting into your e mail handle, then making a password. It’s going to then take you thru a collection of screens that can ask you questions in regard to your private info, earnings and employment, belongings, credit score, and different essential info for a mortgage mortgage utility.

When you submit your accomplished on-line utility, will probably be reviewed, and also you’ll hear again inside one enterprise day.

Your credit score report will likely be pulled, however you’ll not need to pay a price for the report.

Tax transcripts from the IRS will confirm your earnings. That is normally completed by having you full IRS Type 4506, Request for Transcript of Tax Return.

When you hear out of your appointed Residence Mortgage Advisor you’ll have a possibility to lock your rate of interest. You’ll obtain affirmation of the lock inside 24 hours. Mortgage locks are usually good for 45 days.

You’ll be supplied with estimated charges and shutting prices whenever you click on “See Charge Particulars” on the Charge Quote Web page. These will likely be a detailed approximation, primarily based on obtainable info, however closing numbers might differ considerably by closing (that is typical within the mortgage utility course of).

Documentation Submission

Should you’ve ever utilized for a mortgage prior to now, then you definately’re nicely conscious that it’s a paperwork intensive course of. However since all documentation might be submitted to Lenda on-line, the documentation course of is significantly streamlined.

You in all probability have already got sure paperwork, like financial institution statements, retirement statements, pay stubs, W-2s, and even tax returns saved in your pc. All it is advisable to do is add them into the Lenda app, and also you’ll be completed. Even a purchase order contract might be downloaded or emailed, if a replica has been forwarded to you by the actual property agent. Something that’s obtainable in your pc, or net accessible, might be scanned and submitted.

This can remove the necessity to get hold of recordsdata filled with paperwork, copying them, then mailing them out to the mortgage lender.

What Separates Lenda from the Competitors?

One of many foremost components separating Lenda from the competitors–or a minimum of from the mortgage aggregators–is that the corporate is a direct lender. That’s, they not solely course of your mortgage, additionally they fund it.

The usage of devoted mortgage personnel additionally provides them a bonus. There are some on-line lenders who’re making an attempt to maneuver towards a whole technical resolution. However Lenda makes use of actual folks–Residence Mortgage Advisors–to assist information you thru the method. It is a huge benefit, as a result of the documentation and authorized necessities of the mortgage business make it a minimum of considerably expertise resistant. Lenda works round this through the use of a great mix of expertise and human help.

Lastly, there’s the documentation benefit. You’ll be able to add required paperwork to the Lenda platform in a matter of minutes. Whereas conventional mortgage lenders are attempting to maneuver on this route as nicely, Lenda is already there.

Lenda Professionals & Cons

Professionals:

- Lenda allows you to full the mortgage utility course of in a matter of minutes, and from the consolation of your property or workplace.

- You’ll be able to obtain wanted documentation out of your pc, get info from third-party sources on the net, or scan another paperwork essential.

- You’ll be appointed a Residence Mortgage Advisor who will add the human contact to an in any other case on-line expertise.

- Lenda has a wealth of academic sources and calculators that can assist you make the correct mortgage determination.

- You’ll be able to examine price situations, run mortgage calculations, get prequalified, or go for a full mortgage approval.

Cons:

- Lenda is out there in solely 12 states.

- Mortgages obtainable are standard solely, as they don’t present FHA and VA mortgages.

- They don’t present adjustable-rate loans or secondary financing (second mortgages and residential fairness traces of credit score).

- Customer support is out there on Pacific time. Which means for those who dwell on the East Coast, you received’t have the ability to contact Lenda earlier than midday. On a optimistic observe, they are going to be obtainable till 8:00 PM, Japanese time.

Evaluate Mortgage Provides With Lenda Now

Ought to You Get Your Mortgage with Lenda?

The reply to this query actually is determined by the kind of mortgage you intend to use for, and your general earnings scenario and credit score profile. For instance, for those who’re a veteran, and need to apply for a VA mortgage, Lenda doesn’t have this mortgage sort obtainable. The identical is true for FHA loans, that are good for these with less-than-perfect credit score. Nevertheless, Lenda doesn’t present FHA mortgages.

However for those who’re in search of standard financing, both to buy or refinance, Lenda could be a good selection. The mortgage lending course of is de facto the identical from one lender to a different. However what Lenda does is expedite the method via the all-online utility. You’ll be able to full the applying in a matter of minutes, obtain essential documentation with ease, and full the method within the shortest time doable.

One different scenario we did discover in working price situations is that the rate of interest tends to be decrease on larger mortgage quantities. For instance, after we ran a $200,000 mortgage quantity, we bought a price of 4.50%. However after we ran $400,000, the speed got here again at 4.25%. That would point out Lenda offers extra advantageous pricing to larger mortgage quantities.

Should you’d like extra info, or if you want to use for a mortgage, go to the Lenda web site to get began.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.