Taking out a private mortgage is a giant monetary resolution, so it’s essential to know precisely what you’re doing.

We’ve put collectively a listing of issues to think about earlier than taking out a private mortgage.

In This Article:

- Issues To Do Earlier than Making use of for a Private Mortgage

- The Finest Mortgage Comparability Platform

- What to Look For in a Lender

- Completely different Sorts of Private Loans

- Typical Mortgage Software Paperwork

- Often Requested Questions (FAQs)

- Last Ideas

Issues To Do Earlier than Making use of for a Private Mortgage

There’s no scarcity of issues to know earlier than taking out a private mortgage. Quite than bounce into the private mortgage utility course of with out giving it a second thought, listed below are 9 steps to take.

1. Examine Your Funds

Doing so offers you a greater thought of when you can afford one other month-to-month mortgage cost. That is step primary, so don’t do something till you full it.

2. Examine Your Credit score Report

Your aim is to acquire a high-level overview of your money owed, whereas additionally studying extra about your credit score rating.

3. Contact a Monetary Advisor

A monetary advisor can reply your questions, present steerage, and provide help to determine for or towards a private mortgage.

4. Work Out Your Month-to-month Debt Funds

You have to keep on monitor together with your private mortgage repayments. An enormous a part of that is realizing your present month-to-month debt funds.

5. Make a Be aware of Your Whole Revenue

Do you earn sufficient cash to tackle a private mortgage? Does your revenue fluctuate?

6. Make a Be aware of your Belongings and Liabilities

Write down each your property and liabilities. Overview them rigorously to find out if there’s any cause to forgo a private mortgage at this level.

7. Manage Your Paperwork

When finishing a private mortgage utility, you’re prone to be requested for issues similar to a pay stub, financial institution statements, and proof of employment.

8. Work Out What You Can Afford Earlier than Making use of

Simply the identical as some other sort of mortgage, it is best to know what you’ll be able to afford so as to add to your finances earlier than finishing an utility.

9. Store Round Fastidiously

Don’t assume that one private mortgage lender is identical as the following. With an in depth method to private mortgage procuring, you’ll achieve a greater understanding of what’s out there and what’s finest for you.

The Finest Mortgage Comparability Platform

A sound private mortgage comparability will go a great distance in serving to you make an knowledgeable and assured resolution.

Monevo is the perfect private mortgage comparability device, because it offers you the chance to buy a number of lenders inside a matter of minutes.

Additionally, you should utilize Monevo to filter your outcomes, similar to by credit score rating and the sum of money you wish to borrow.

If you wish to discover the perfect mortgage in your private funds, Monevo is a device that you simply want by your aspect.

What to Look For in a Lender

Private mortgage procuring is all about discovering a lender that fits you and your monetary circumstances. Listed here are a number of the issues it is best to search for.

Expertise and Credibility

The perfect lenders have a few years of expertise mixed with a status for doing issues the precise method.

Curiosity Charges

You need your private mortgage rate of interest to be as little as potential. The decrease the speed, the decrease your month-to-month cost. Concentrate on this element as you examine lenders.

Compensation Flexibility

What reimbursement durations can be found? Is the lender versatile sufficient to satisfy your wants? Your month-to-month cost is predicated largely on the time period you select.

Response Occasions

The private mortgage utility course of isn’t complicated. When you submit your utility, it is best to anticipate to obtain a choice inside 24 to 48 hours, on the most.

Buyer Service

The private mortgage supplier you select ought to be devoted to offering a high-level customer support expertise. This can put your thoughts comfy.

Completely different Sorts of Private Loans

In an general sense, there are two varieties of private loans:

- Unsecured mortgage: An unsecured mortgage is one that doesn’t require collateral. The lender takes on extra threat with one of these mortgage.

- Secured mortgage: A secured mortgage requires collateral.

Most private loans are unsecured, however you could discover a lender that gives a secured possibility as a way of getting a decrease rate of interest.

Typical Mortgage Software Paperwork

The private mortgage utility course of is stuffed with documentation. Fortuitously, if you get hold of the precise paperwork early on, it’ll prevent time sooner or later. Right here’s what it is best to have prepared:

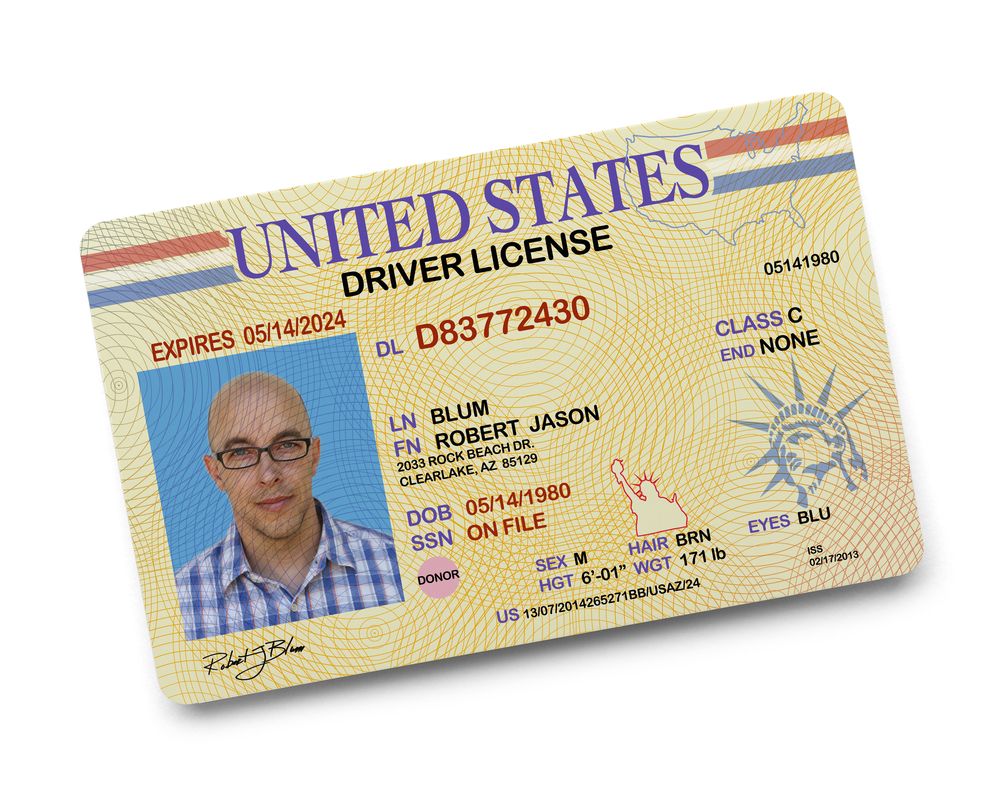

Proof of Id

A driver’s license could also be all you want, however your lender may require two varieties of proof.

Employer and Revenue Verification

A pay stub is usually ok, however your private mortgage lender might wish to contact your employer to confirm your standing.

Proof of Deal with

The commonest proof of tackle is a duplicate of a financial institution assertion or utility invoice.

Earlier than you full an utility, ask your lender what sort of documentation they want. This can let you accumulate it upfront, so that you don’t get caught without warning down the street.

Often Requested Questions (FAQs)

With so many issues to think about earlier than taking out a private mortgage, it’s simple to develop into overwhelmed. Nonetheless, you’ll be able to struggle towards this by answering any and each query that’s in your thoughts.

Listed here are a number of the most steadily requested questions as they pertain to private loans.

What is an effective credit score rating?

In response to Experian, a superb credit score rating falls within the vary of 700 to 850. The upper your credit score rating the simpler it’s to get a private mortgage.

How do private loans work?

When you apply for a private mortgage and obtain approval, you’ll be able to then settle for or deny the funds. Must you be keen on shifting ahead, your lender will wire the funds to your checking account. You might be then free to make use of the cash nevertheless you finest see match.

What’s a secured mortgage?

A secured mortgage requires collateral. For instance, a automobile mortgage is a secured mortgage because the car acts as collateral. The lender can repossess it when you default on funds.

What’s an unsecured mortgage?

An unsecured mortgage is a kind of mortgage that doesn’t require collateral. For the reason that lender is taking over extra threat, the rate of interest is usually increased. Most private loans are unsecured loans.

Do private loans influence your credit score rating?

Sure, a private mortgage will influence your credit score rating. Your private mortgage lender will report exercise to the three main credit score bureaus. So long as you pay in full and on time, your mortgage could have a constructive influence in your rating.

How a lot can I borrow for a private mortgage?

This is dependent upon quite a lot of components, such because the lender you select, your credit score rating, your revenue, and your debt load. Bear in mind this: you don’t need to borrow as a lot cash as you qualify for. Make your resolution primarily based in your wants and private funds as an entire.

Do mortgage firms examine your checking account?

Sure, mortgage firms examine your checking account(s). They achieve this to confirm your revenue and to point out how a lot cash comes into and goes out of your account. This holds true for all sorts of loans, from private loans to mortgages.

Do private mortgage lenders contact your employer?

This is dependent upon your private mortgage supplier. Some will contact employers to confirm employment. Others are okay with doing so by way of a current pay stub.

Do it’s worthwhile to give a cause for a private mortgage?

Whereas your lender might ask why you desire a private mortgage, there’s no proper or unsuitable reply. So long as you intend on utilizing the cash for authorized causes, you have to be okay.

How a lot of a private mortgage are you able to afford?

Answering this query begins with a evaluation of your finances, revenue, and present mortgage repayments. From there, you’ll be able to determine how a lot of a month-to-month mortgage cost you’re comfy with.

Which reimbursement interval is finest for you?

Private mortgage phrases range. Most lenders provide loans starting from 12 to 96 months, nevertheless, this may and can range. The longer your time period, the decrease your cost. Nonetheless, a long term additionally implies that your private mortgage rate of interest could have an even bigger influence.

Are you aware precisely the way you wish to use the funds from a private mortgage?

If you happen to qualify for a private mortgage, it seems like a no brainer to simply accept the funds. However earlier than you do that, clearly outline the way you’ll use the cash.

Last Ideas

These are the varieties of issues to know earlier than taking out a private mortgage. Regardless of how a lot cash you wish to borrow or which lender you wish to use, make sure that you might have a full understanding of your private monetary circumstances.

With the precise data, it’s simpler to determine for or towards a private mortgage. Must you notice that now’s the time to use, examine lenders with the thought of discovering the one which finest matches your desires, wants, and finances.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.