Owners over the age of 62 have a singular choice accessible for accessing money. Reverse mortgages might help seniors entry house fairness with out having to make month-to-month funds to repay a mortgage. When a qualifying home-owner has paid off a mortgage in full, or could be very near paying off a mortgage, a reverse mortgage (or house fairness conversion mortgage) can flip the fairness into money by means of a fee plan. The reverse mortgage is repaid from the proceeds when the proprietor sells the home.

For seniors who’ve found their bills are greater than what they’ve deliberate, a reverse mortgage might help pay the payments. Contemplating you may’t take your wealth with you once you die, there’s all the time a case for spending down your property when you nonetheless have time to get pleasure from your life.

If these are two of the advantages to reverse mortgages, they could be simply overshadowed by the drawbacks.

- Reverse mortgages are costly. Similar to common mortgages, you’ll have closing charges and factors to pay. They’ll be rolled into the mortgage quantity, so once you or your property pays again the mortgage when the house is bought or once you die, you’ll owe greater than the transformed fairness plus curiosity.

- You’ll be on the mercy of the market. Reverse mortgages have rates of interest, similar to common mortgages. This curiosity will even add to the entire you’ll must repay the mortgage after the sale, and if this rate of interest is greater than inflation, you’re shedding extra total worth.

- You won’t qualify for Medicaid. The proceeds from a reverse mortgage enhance your revenue. In the event you’ve been counting on Medicaid, you could not qualify.

The primary level above, the truth that reverse mortgages are costly, is a crucial level to think about. Listed here are a number of the bills related to reverse mortgages:

- Mortgage insurance coverage (2% of the appraised house worth)

- Origination payment (as much as $6,000)

- Title insurance coverage

- Title, lawyer, and county recording charges

- Actual property appraisal ($300–$500)

- Survey ($300–$500)

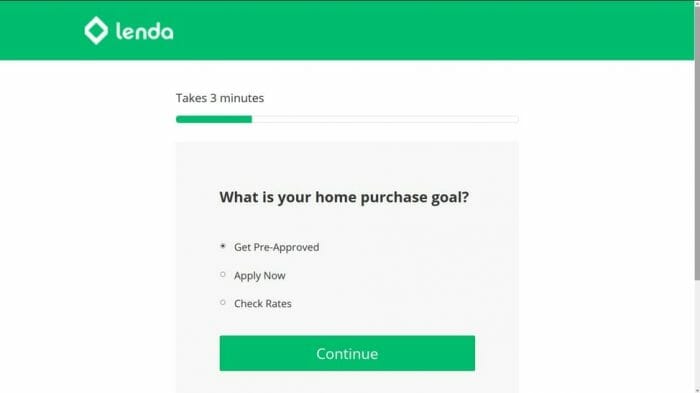

In an effort to qualify for a reverse mortgage, the U.S. Division of Housing and City Growth (HUD) requires you to obtain counseling, which helps debtors perceive the ideas of reverse mortgages and identifies the very best lenders.

Wells Fargo and Financial institution of America have just lately exited the reverse mortgage enterprise. They are saying that HUD necessities go to far to restrict lender’s profitability, however in all probability, lenders are having a more durable time being profitable from reverse mortgages — which have been very worthwhile throughout the top of the true property market — now that house costs are low. Reverse mortgages, like conventional mortgages, are packaged and bought to buyers, and if lenders are having a troublesome time discovering buyers for these securities, they’ll cease doing enterprise.

Whereas Wells Fargo and Financial institution of America are not providing reverse mortgages, MetLife is rising its reverse mortgage enterprise.

Because of the excessive charges, most reverse mortgages are seen as predatory merchandise. I can perceive the enchantment of having access to money locked away in house fairness, nevertheless it comes at a excessive worth. Many individuals argue you could’t be buried along with your wealth, however there are methods to make it be just right for you after your die if promoting your home is just not interesting when you’re nonetheless alive.

Picture: Warren Brown Pictures

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.