Attempting to find out whether or not or to not refinance a mortgage? In our data, we stroll you via refinance a mortgage and the place to hunt out the simplest prices.

Have you ever ever been in your current home mortgage for a few years? Do you see marketed mortgage prices successfully below what you’re locked in for? And do marvel ought to you might decrease your bills by refinancing?

Do you have to’ve considered a refi in your current home mortgage, there are some issues to ponder. Whereas the strategy itself isn’t powerful, it is a bit involved. You’ll want to retailer spherical, and it is best to undoubtedly ask your self some questions first.

We’d favor to simple the strategy and supply assist to find out your subsequent mortgage switch. Proper right here’s each half it is worthwhile to know when you’re fascinated by refinancing your personal dwelling.

Check LendingTree for the guidelines of mortgage prices from most popular suppliers

In This Article:

- When Should You Refinance?

- Mortgage Refinance Calculator

- Will You Save Money?

When Should You Refinance?

There are a few key instances during which you’d most likely ponder refinancing your mortgage. Let’s focus on a number of of them.

Curiosity Fees Have Dropped

Following the housing crash in 2007-08, mortgage charges of curiosity began to plummet. They reached an all-time report low of three.31 % on November 22, 2012 sooner than trending once more upward. Then, in June 2016, they dipped as soon as extra, reaching as little as 3.56 %.

Closing month (August 2017), the frequent mortgage charge of curiosity was 3.88 %. Let’s say you bought your personal dwelling eleven years prior to now, in July 2006, when the frequent charge of curiosity was 6.76 %. That’s a distinction of two.88 %, and it is best to undoubtedly look into refinancing your charge. You’ll undoubtedly save your self a reasonably penny in the long term.

Nevertheless what do you have to suppose you will get a charge at current that’s solely larger by a % or two? Is that undoubtedly definitely worth the time, effort, and money involved with a refi?

Properly, even 1-2 % may make for some extreme monetary financial savings on a mortgage. Merely check out this comparability:

As you can see, a 30-year mortgage for a $200,000 home (with a $20,000 down price) will worth you $177,840 in curiosity alone in case your charge is 5.25 %. However, do you have to had been to lower that to 4.25 %, you’d solely pay $138,600 in curiosity (a monetary financial savings of $39,240). And do you have to snagged a 3.25 % charge, you’d solely pay $101,880 (which suggests $75,960 saved).

That “solely a %” or two actually goes an ideal distance.

We’re going to focus on calculate the exact monetary financial savings in solely a bit. Nevertheless for now, know that if charges of curiosity have dropped, refinancing your personal house is a minimal of worth considering.

Your Credit score rating Score Has Improved

As you may be definitely already aware, your credit score rating performs a activity in determining the mortgage loans and prices for which you qualify. So, in case your credit score rating has modified for the upper, a refi is worth considering.

Everytime you first took out your genuine home mortgage, your credit score rating historic previous on the time was a serious deciding difficulty. Your lender used it to approve your mortgage and decide which charge of curiosity they wanted to provide you.

Inside the years which have handed, have you ever ever paid off cash owed? Elevated card limits? Have unfavourable experiences been eradicated out of your credit score rating? If that is the case, your credit score rating has seemingly improved and, in flip, you’re most likely eligible for a better charge than you had been when you first obtained your mortgage.

You Have to Lower Your Month-to-month Charge

One trigger that some folks refinance their mortgage is to lower their month-to-month funds. This isn’t on a regular basis the wisest selection, as a result of it typically requires extending the mortgage dimension. However, in some circumstances, it’s important.

For example, let’s say that you just’ve been in your home for ten years (with an genuine 30-year mortgage) and currently determined that your price is just too extreme. You’ve been slowly paying the debt down over the earlier decade, nonetheless the month-to-month bill has begun placing a stress in your funds. You’d favor it lowered, nonetheless what can you do?

Properly, you can refinance the now-reduced steadiness, with 20 years left, right into a model new 30-year mortgage. It is going to unfold the remaining steadiness out over an prolonged timeframe, lowering your month-to-month funds.

You can too make this a more sensible choice by moreover working to secure a lowered charge of curiosity. However, attempt to be aware that, over time, you’re seemingly going to pay further by going this particular refinance route. As talked about, though, it’s sometimes a necessity, and is one factor to ponder in case your month-to-month funds have flip into unmanageable.

You Need Cash

Some debtors will ponder a mortgage refi within the occasion that they want to get cash out of their home’s equity. This system often called a cash-out refinance, and it’s very completely different than a HELOC, or home equity line of credit score rating.

With a cash-out refinance, you’ll be refinancing the home for better than you at current owe, with the intention to pocket the cash for an additional use. This could be a route you may ponder do you have to need money for a home rework or the like.

Let’s say that you just keep in a home worth $300,000, nonetheless you solely owe $200,000 in your mortgage. (On this case, you may need $100,000 worth of equity constructed up inside the home.) You need $60,000 to assemble an addition onto the once more of the house, and decide that using your personal dwelling’s equity is an effective suggestion.

You may need two decisions: cash-out refinance or HELOC. With the cash-out refinance, you’ll take out a model new mortgage worth $265,000, then use $200,000 of that to repay the distinctive mortgage. In the end, you’ll solely have one observe on the home and may pocket the $60,000 (roughly, after closing costs and such).

Conversely, a HELOC entails taking a second mortgage out in the direction of the equity of your personal dwelling. This $60,000 (or irrespective of amount) line of credit score rating may probably be taken out alongside together with your genuine lender or a model new one; it doesn’t matter. Consider, though, that ought to you spend in the direction of that line of credit score rating, you may now have two month-to-month funds: one for the distinctive mortgage and one to repay the HELOC.

HELOCs typically have elevated charges of curiosity compared with refinanced mortgages. However, whereas a cash-out refinance is easier in the case of solely managing one debt, a revenue with the HELOC is that it doesn’t have closing costs.

Sooner than you identify to utilize your personal dwelling’s equity as a provide of cash, make certain you do the arithmetic. You may end up costing your self further in the long run (and shedding the protection of your personal dwelling’s built-up equity) throughout the course of.

Mortgage Refinance Calculator

Charge decisions

Will You Save Money?

An important question when considering a mortgage refi, for most people, is, “Will it save me money?” Whereas the reply is completely completely different for everyone, there are a few key parts to ponder when doing all of your calculations.

Can You Do Increased?

First, resolve whether or not or not or not you’ll get a lower charge of curiosity. If that’s your trigger for exploring a refi, it is worthwhile to know if it’s the suitable time.

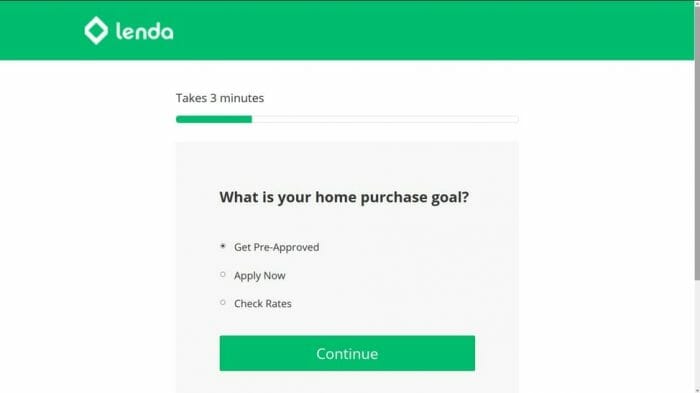

Check out present developments in mortgage prices and the way in which lots the current marketed prices differ out of your current charge. You’ll even apply and see what you qualify for by way of a few completely completely different lenders. There are mortgage aggregator devices obtainable (to view quite a lot of lenders at once), or you can merely retailer spherical.

Stand up-to-date credit score rating experiences and scores (completely free!) to know the place you stand. If there are financial institution card balances which you would pay down or unfavourable experiences which may be about to fall off, it’s worth holding off in your refi for a few months. That technique, your credit score rating is in the simplest place it might be in sooner than you apply.

Moreover bear in mind that in case you’ve got quite a lot of lenders pull your credit score rating all through the an identical 14-day timeframe, it’ll solely rely in the direction of your credit score rating report as quickly as. This “charge buying” timeframe can go as extreme as 45 days with some FICO scoring fashions. Nevertheless the older fashions (which some lenders nonetheless use) solely give you 14 days. Since you under no circumstances know which model a attainable lender will use, keep that in ideas.

Gather your belongings and retailer away.

Breakeven stage

To find out whether or not or not refinancing your mortgage is the best financial switch, you’ll should know your breakeven stage. As a result of the title suggests, that’s the objective at which you may break even between what a refi costs you and the way in which lots it’ll stop. Do you have to intend to advertise your personal dwelling sooner than this stage, refinancing is a waste of time and money.

In an effort to resolve your breakeven stage, you’ll should know your mortgage origination fee. Whereas this can possible differ from lender to lender, it’s typically spherical 1% of the mortgage full. So, do you have to’re refinancing your personal dwelling for $200,000, you can depend in your mortgage origination fee to be roughly $2,000.

As quickly as you notice that and have a standard considered what your new charge of curiosity may be, you need to use a mortgage comparability calculator (like this one) to see when your monetary financial savings shall be realized. It’ll consider your genuine (current) mortgage mortgage with a model new, refinanced mortgage to see if and when you’ll decrease your bills.

It’ll current you your breakeven stage, along with the aim at which you’ll stop seeing monetary financial savings (in case you’ve got too prolonged of a refinance time interval, for instance). That technique, you perceive how prolonged it is best to refinance your personal dwelling for, so you can steer clear of throwing money away.

Deciding whether or not or not or not a mortgage refi is greatest for you is a non-public selection. It depends in your credit score rating ranking, how lots you owe, current charge developments, and your trigger for refinancing.

However, by doing a bit of bit little little bit of homework–and some math–you can be sure that you simply make the best financial selection on your family members and your personal dwelling.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.