There are various issues to think about earlier than taking out a private mortgage. A deal with the fitting particulars offers you the arrogance it is advisable make an knowledgeable choice.

In This Article:

- What to Ask Your self Earlier than Making use of for a Private Mortgage

- The Greatest Mortgage Comparability Platform

- What to Look For in a Lender

- Completely different Sorts of Loans

- Typical Mortgage Software Paperwork

- Incessantly Requested Questions (FAQs)

- Remaining Ideas on Making use of for a Private Mortgage

What to Ask Your self Earlier than Making use of for a Private Mortgage

There are a selection of questions you must ask and reply earlier than finishing a private mortgage software. Listed here are 9 of an important:

1. Do I meet the necessities to qualify for a private mortgage?

Do your analysis to higher perceive the necessities to qualify for a private mortgage. Is your credit score rating excessive sufficient? Does your earnings meet the minimal threshold?

2. What’s the private mortgage for?

If you happen to don’t know why you need a private mortgage it’s greatest to carry off in the interim. Even in the event you qualify, it’s by no means a good suggestion to borrow cash only for the sake of doing so.

3. What are the rates of interest?

Private mortgage rates of interest will differ from vendor to vendor. This will likely affect your choice on which private mortgage to decide on, as it would have an effect on how a lot you pay month-to-month and over the course of your mortgage.

4. What are the charges related to a private mortgage?

This varies from lender to lender. Curiosity is the most typical payment, however you may additionally run into others, reminiscent of a processing payment and software payment.

5. What’s the time period of the mortgage?

Verify together with your private mortgage lender to know the phrases which might be accessible to you. For instance, your lender might supply phrases starting from 12 months to 96 months.

6. How will you pay it off?

As an installment mortgage, you’ll make a hard and fast cost each month. If you happen to pay simply this quantity, it’ll take your entire time period to repay your mortgage.

7. Can I afford to pay greater than the minimal quantity every month?

Ask your private mortgage supplier in the event you’re capable of pay greater than the minimal quantity every month. Doing so saves you cash on curiosity.

8. Are there any higher alternate options to a private mortgage?

There are different kinds of loans to think about, reminiscent of a house fairness mortgage. Examine the professionals and cons of all of your choices to find out what’s greatest.

9. What is going to I do if my software is declined?

The private mortgage software course of might finish in disappointment. In case your software is declined, discover out why after which decide what you are able to do to enhance your odds of approval sooner or later.

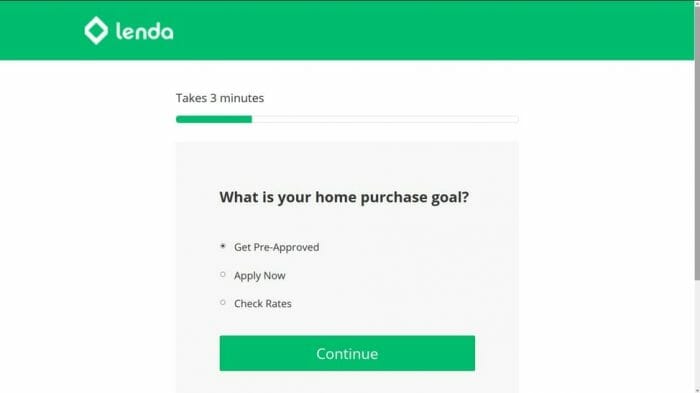

The Greatest Mortgage Comparability Platform

Private mortgage purchasing is simpler at present than ever earlier than, because of the flexibility to match loans on-line.

If you happen to need assistance with the non-public mortgage comparability course of, Monevo is without doubt one of the many instruments to think about.

With this platform, one software offers you entry to a number of lenders. This protects you time evaluating lenders and loans.

You may also filter outcomes based mostly in your mortgage quantity and estimated credit score rating.

Don’t let private mortgage purchasing bitter the expertise. Use a web based platform — reminiscent of Monevo — to convey pace and effectivity to the method.

What to Look For in a Lender

It’s straightforward to imagine that each private mortgage supplier is mainly the identical, however that’s not true.

Understanding what to search for in a lender is essential to creating an knowledgeable choice. Right here’s the place you must spend most of your time.

Expertise and Credibility

Irrespective of the kind of mortgage, you must solely think about lenders which might be skilled and credible. There’s by no means a great time to take a danger together with your funds.

Curiosity Charges

Your private mortgage rate of interest will affect your funds, together with your month-to-month finances. Examine lenders with the objective of discovering the one that gives the bottom rate of interest.

Reimbursement Flexibility

What month-to-month mortgage cost are you snug with? What phrases can be found to you? Is there compensation flexibility? One of the best lenders work with you to discover a mortgage that fits your finances.

Response Occasions

It’s irritating to use for a mortgage, simply to seek out that your lender is dragging its toes. Response occasions are essential from the beginning.

Buyer Service

Your private mortgage comparability ought to focus closely on customer support. A lender that actually cares about what you are promoting is one which’s accessible and prepared to reply all of your questions.

Completely different Sorts of Loans

Private loans match into certainly one of two classes:

Unsecured mortgage

Most private loans are unsecured. With an unsecured mortgage, you’re not required to place up any collateral. That is riskier for the lender, so you may count on the next rate of interest (reminiscent of when in comparison with a house fairness mortgage).

Secured mortgage

A secured mortgage requires collateral. It’s not frequent with private loans, however chances are you’ll discover a lender that gives this feature.

Typical Mortgage Software Paperwork

Relating to issues to know earlier than taking out a private mortgage, documentation must be someplace close to the highest of your precedence record.

You need to acquire all the mandatory software paperwork upfront, as this enables for the method to unfold extra easily.

Proof of Identification

The simplest strategy to show your id is with a duplicate of your driver’s license. In case your lender requires one other type of identification, a start certificates or Social Safety card will do.

Employer and Revenue Verification

You’ll be able to confirm each your employment and earnings by offering your lender with a current pay stub.

Your lender might also contact your employer to confirm your employment.

Proof of Deal with

A utility invoice or mortgage assertion is usually sufficient for proof of tackle.

Incessantly Requested Questions (FAQs)

Simply the identical as something together with your private funds, you’re more likely to have questions on a private mortgage earlier than making use of. Answering these questions will assist put your thoughts comfortable.

What is an efficient credit score rating?

Experian notes {that a} good credit score rating is one which falls between 700 and 850. If you happen to’re wanting this, think about the steps you may take to spice up your rating earlier than making use of for a mortgage.

How do private loans work?

When you apply for a mortgage and obtain approval, you’ll evaluate the phrases and situations. It’s throughout this time that you simply’ll be taught extra about accessible compensation durations and the rate of interest you qualify for. If you happen to settle for the funds, you’re then required to repay them month-to-month over the time period of your mortgage.

What’s a secured mortgage?

That is a kind of issues to think about earlier than taking out a private mortgage that some folks overlook. A secured mortgage requires collateral. This isn’t frequent with a private mortgage, so it’s not typically one thing you must plan for.

What’s an unsecured mortgage?

Nearly all of private loans are unsecured, which means that your lender doesn’t require collateral. Whereas it is a profit to you, it additionally locations extra danger on the lender. They’ll mitigate this by charging the next price of curiosity.

Do private loans affect your credit score rating?

Sure. Most significantly, your mortgage repayments turn into a part of your credit score report, which impacts your rating. By paying in full and on time, you should use a private mortgage to spice up your rating.

How a lot can I borrow for a private mortgage?

This will depend on many components, reminiscent of your private mortgage lender, earnings, and credit score rating. Irrespective of how a lot you qualify for, ensure that you’re solely borrowing what you want.

Do mortgage firms examine your checking account?

Mortgage firms need to be taught as a lot as they will about your private funds. So, most lenders examine your checking account to confirm your earnings and take a more in-depth have a look at how cash comes out and in.

Do private mortgage lenders contact your employer?

Sooner or later within the mortgage software course of, your lender might contact your employer. They achieve this to confirm your employment.

Do it is advisable give a motive for a private mortgage?

When finishing a private mortgage software, your lender might ask how you intend on utilizing the funds. You don’t have to supply a motive, however there’s no hurt in doing so (so long as you want the cash for authorized functions, in fact).

Are you able to afford to repay your mortgage based mostly on the phrases and situations supplied?

Your compensation interval will affect how lengthy you make funds, in addition to the quantity. Be sure to’re snug with mortgage repayments earlier than you settle for funds. You don’t need your month-to-month mortgage cost to bathroom you down.

Remaining Ideas on Making use of for a Private Mortgage

These are the kinds of issues to know earlier than taking out a private mortgage. With this steering, you must really feel extra snug with the method, the affect in your private funds, and the best way a private mortgage can profit you.

If you happen to’re uncomfortable with any element of a private mortgage, step again to reassess your scenario and decide what to do subsequent. The extra questions you ask and reply, the better it turns into to proceed with confidence.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.