It’s tax season within the U.S., and the IRS needs to know in case you offered or purchased any cryptocurrencies in 2019.

For the primary time, the IRS will ask if “At any time throughout 2019, did you obtain, promote, ship, change or in any other case purchase any monetary curiosity in any digital foreign money?”

Digital foreign money is a vital addition to the 1040 this yr,” IRS Commissioner Charles Rettig mentioned in a press launch. “This rising space is a precedence for the IRS, and we need to assist taxpayers perceive their obligations involving digital foreign money. We may even take steps to make sure truthful enforcement of the tax legal guidelines for individuals who don’t observe the principles involving digital foreign money.

Whereas it’d appear to be a easy sure or no query, there are a number of methods wherein you’ll have interacted with cryptocurrencies. And in case you say no, it’s nonetheless doable that tax authorities might discover out in any case. The IRS despatched letters to greater than 10,000 taxpayers in 2019 who it suspected had did not report transactions as revenue.

How The IRS Handles Crypto

Just about currencies are handled as property by the IRS, just like shares funding. Identical to your inventory portfolio, they count on you to report how a lot you acquired and pay revenue on these transactions.

Cryptos aren’t certified as currencies, which signifies that you can’t declare international foreign money loss or features. Shopping for and promoting cryptocurrency is taxable, as is mining any foreign money.

In the meantime, if you’re paid digital foreign money from an employer, it’s handled as wages and should pay revenue tax, FICA tax, and unemployment taxes. If you happen to’re a contractor, then you’ll have to pay self-employment tax.

What To Do If You Had Crypto Transactions In 2019

If you happen to acquired any digital foreign money and owe revenue taxes to the U.S, then be sure you reply sure to the IRS’s query about crypto. You will need to embody the truthful market worth of that foreign money in U.S. {dollars} on the time cryptos had been acquired. Examine the dates of once you acquired crypto to be sure you are placing the best value in, because the crypto market may be risky from day-to-day.

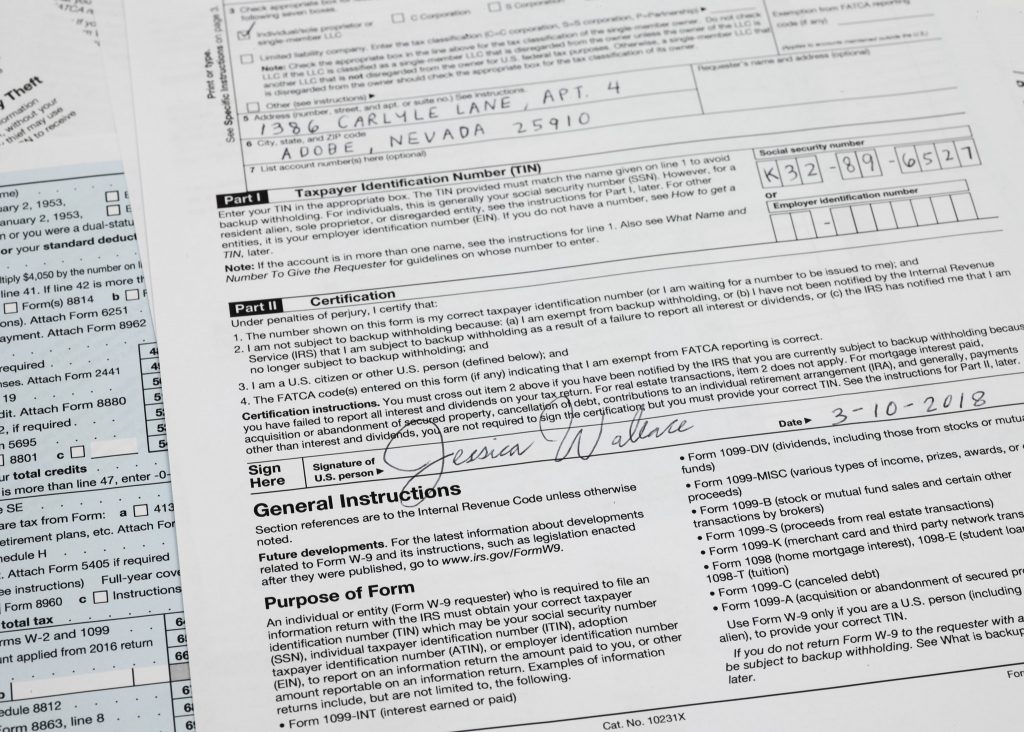

You need to create a paper path, as even the smallest transaction could possibly be taxed. Whereas some crypto exchanges like Coinbase offer you a Type 1099-Ok along with your operations, not all crypto exchanges preserve observe, or they could solely offer you one in case you had a specific amount of transactions. The easiest way is to maintain observe of your crypto transactions is to do it by your self.

The value of not reporting your crypto operations could possibly be expensive and should get you audited by the IRS. You can get a wonderful of as much as $250,00 and probably face jail time in essentially the most excessive circumstances.

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.