Whereas Social Finance, typically referred to as SoFi, started out as a pupil mortgage refinancing agency in 2011, they’ve quickly flip right into a lending powerhouse. Proper now, the company affords financial merchandise for numerous needs, from their flagship pupil mortgage refis to private loans and even mortgages by way of the currently launched SoFi Mortgage LLC.

Whether or not or not you are wanting into this widespread lender for a giant dwelling enchancment problem on the horizon, want to chop again your pupil mortgage repayments, or should cowl medical payments, SoFi has you coated. They even present funding administration and life insurance coverage protection decisions these days–within the current day, though, we’re solely going to talk about loans.

SoFi’s decisions and expenses are very aggressive, and the company makes it easier than ever to deal with your borrowing. Let’s take a look at exactly what SoFi has to provide, the choices involved with each form of mortgage, and who this agency caters to in relation to refinancing and lending.

In This Article:

- SoFi Pupil Mortgage Refinancing

- SoFi Non-public Loans

- SoFi Mortgages

- Is SoFi Correct for Me?

SoFi Pupil Mortgage Refinancing

The first service that SoFi launched–and the one the company is best-known for–is pupil mortgage refinancing.

Their refinancing loans present to keep away from losing you every time and money in your basic compensation and are positively value a look you most likely have painful charges of curiosity or nonetheless carry a giant steadiness.

The tactic for pupil mortgage refinancing by way of SoFi is easy, and approval is on the spot. You probably can have a name in decrease than two minutes when you full the making use of on-line, and their course of ensures to be totally clear. You probably may even apply and get your payment decisions with out impacting your credit score rating.

Check-out Just a few of The Biggest Pupil Loans Refinance Presents With SoFi

The Utility Course of

Making use of for a pupil mortgage refinance by way of SoFi is pretty easy. You’ll be pre-qualified on-line in two minutes or a lot much less and provided a refi charge of curiosity, all with out impacting your credit score rating.

You’ll need some objects of information to begin out the rate-shopping course of. This accommodates your:

- Establish and deal with

- Date of begin

- E-mail deal with

While you enter this information, you’ll even be requested in order so as to add an account password. This trend, you probably can verify in and resume your software program or revisit your refi payment, do you have to’re not ready to complete the strategy within the current day.

Then, you’ll be requested to provide your:

- Citizenship standing

- Homeownership standing

- Highest coaching diploma completed and diploma program information

- Annual income

- Refinance mortgage amount requested

While you’ve entered all of this information, you’ll be succesful to check your refi payment by way of SoFi. In case you similar to the numbers you see, you probably can full the strategy for the mortgage on the spot. Sooner than your mortgage origination is full, SoFi might also pull a tricky inquiry in your credit score rating. That’s the main time that your credit score rating report will probably be impacted all by means of the making use of course of, though.

Should you want to proceed procuring spherical for expenses or aren’t happy with what SoFi affords, then no damage, no foul. You probably can exit the making use of (signing once more in to complete it later, ought to you choose) with none have an effect on to your credit score rating or funds.

Fees

There usually are not any origination or software program expenses involved alongside along with your SoFi pupil mortgage refinance. Nor are there any expenses for prepayment. Which signifies that you most likely have additional room in your funds–or experience a cash windfall–you probably can repay your refinanced mortgage just a little bit early with none penalty.

The one added costs you’ll discover alongside along with your refinanced pupil mortgage(s) are, in reality, the charged curiosity on the model new mortgage.

Curiosity Fees

A pupil mortgage refinances by way of SoFi is definitely rolling fairly a couple of smaller loans into one better mortgage, in an attempt to keep away from losing every money and time all through the compensation. And whereas it could prevent some important cash by refinancing by way of SoFi, you probably can nonetheless depend on to pay curiosity expenses over the course of the mortgage.

Your specific particular person charge of curiosity will depend on fairly a couple of non-public elements. These embody:

- Your credit score rating historic previous (along with its dimension, whether or not or not you can have any damaging research, and your credit score rating utilization)

- Your present loans’ compensation historic previous (how prolonged you’ve been paying them off, whether or not or not you’ve struggled to pay the minimal due, and so forth.)

- Your income

- The compensation dimension you’re requesting with the refinance mortgage

- Whether or not or not you’re making use of with a co-signer

Curiosity expenses may be discovered as fixed-rate or variable, relying in your needs and the form of mortgage compensation you search. Charges of curiosity are altering frequently, nonetheless SoFi in the mean time affords expenses ranging from 3.899% to 7.949% for fixed-rate and a pair of.470% to 7.170% for variable payment loans. Every mortgage kinds present a 0.25% low value for signing up for AutoPay. That’s specific to pupil loans.

The shorter the compensation time interval, the upper your credit score rating historic previous, and the higher your credit score rating score, the lower your charge of curiosity will probably be. Moreover, you can be succesful to see the charges of curiosity you’re being provided by SoFi sooner than they pull a tricky inquiry in your credit score rating report.

Who It’s For

SoFi is an excellent chance for refinancing your pupil loans, but it surely certainly isn’t for everyone. Truly, some debtors may need a difficult time getting authorised for a refinance, until they’ve constructed up a secure ample compensation historic previous.

Should you’re a U.S. citizen or eternal resident and have a credit score rating score of not lower than 650, you’re invited to make use of for a SoFi pupil mortgage refinance. A credit score rating score lower than that is almost optimistic to finish in a denied software program, so you can want to use elsewhere or work to ship your credit score rating score up earlier to submitting an software program.

SoFi will also be geared to those debtors who’ve a confirmed historic previous of optimistic mortgage compensation. In case you’ve solely not too long ago graduated and solely have months–or a pair years–of mortgage funds beneath your belt, you’re a lot much less extra more likely to get authorised. Spend some time setting up that historic previous and whittling down the stability if you need an approval from SoFi.

Loans may be discovered by way of SoFi with a minimal of $5,000. In case you owe decrease than that in your pupil loans, you gained’t be succesful to refinance by way of the lender.

A pupil mortgage refinance from SoFi will also be greatest for these debtors who’ve high-interest expenses on their loans and wish to chop again the time remaining on their mortgage compensation, the amount they could pay in curiosity, or every. In case you in the mean time have loans with low-cost charges of curiosity or are almost accomplished paying them off, SoFi will not do lots good. Nonetheless, in case you might be in the mean time paying once more loans with charges of curiosity above 9%, or have 1000’s (or tens of 1000’s) nonetheless owed, chances are you’ll doubtlessly save your self pretty a bit with SoFi.

Mum or dad PLUS Loans

Mum or dad PLUS loans are a bit troublesome in relation to refinancing, as they don’t seem to be on a regular basis able to be consolidated into the an identical refi as private pupil loans. With SoFi, though, you probably can refinance every your private pupil loans and your Mum or dad PLUS loans in a single.

As long as you meet the same old mortgage requirements set forth by SoFi, you’ll be succesful to refinance your Mum or dad PLUS loans. This accommodates being a U.S. citizen or eternal resident, having a job or guarantee of employment inside the subsequent 90 days, holding an affiliate’s diploma or better from an accredited school, and meeting minimal income-vs-expenses requirements.

Residency Pupil Loans

SoFi has, in latest instances, begun offering residency pupil mortgage refinancing, which wasn’t beforehand obtainable. So, in case you’re a dental or medical school resident and haven’t lower than $10,000 in pupil loans to repay, you probably can apply for a SoFi refinance mortgage.

You probably can have as a lot as 4 years left in your authorised residency program and nonetheless be eligible to make use of. You need to be a U.S. resident or eternal citizen with not lower than two years left until your standing expires. You would even have graduated with an MD, DO, DMD, or DDS from positive U.S.-based Title IV accredited universities or graduate packages.

Underwriting requirements nonetheless apply for residency mortgage refinances. Your income, payments, employment, and credit score rating historic previous will probably be considered, which may have an effect on every your approval and the charges of curiosity provided.

SoFi Non-public Loans

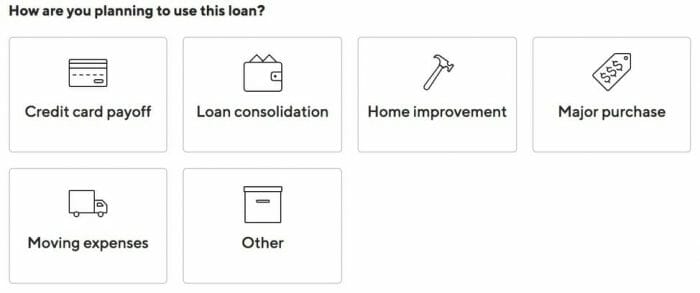

You might keep in mind a non-public mortgage for fairly a couple of causes. There may very well be an enormous dwelling enchancment problem on the horizon, you can have to embark on a model new enterprise enterprise, and even merely plan an thrilling wedding ceremony ceremony or family journey. Or, do you have to’re in the mean time paying off high-interest debt (much like financial institution card balances), a non-public mortgage could very effectively be an answer to every eliminate that debt and in the reduction of your charges of curiosity on the same time.

Whatever the motive is also for needing a non-public mortgage, SoFi might be succesful to provide the acceptable mortgage on the right payment… and the strategy is a little bit of cake.

The Utility Course of

The tactic of creating use of for a SoFi pupil mortgage is quick and simple. An identical to the scholar mortgage refi above, the private mortgage software program course of may very well be completed on-line in mere minutes, all with out impacting your credit score rating.

When making use of on-line, you’ll wish to provide a few objects of personal information. This accommodates your:

- Establish

- State of residence

You’ll then be requested in order so as to add a password, in an effort to revisit your mortgage software program (and supply) afterward.

Subsequent, you’ll should let SoFi perceive how lots you must borrow and why. Non-public loans may be present in portions ranging from $5,000 all the easiest way as a lot as $100,000, counting on whether or not or not you qualify.

Give it a Try! Finance Your Targets With SoFi Now

You’ll moreover wish to present your date of begin and citizenship standing. Subsequent up is your non-public information–your deal with and cellphone amount, whether or not or not you’re renting or private your non-public residence, your annual income, whether or not or not you’re making use of with a cosigner, and an acceptance of SoFi’s phrases.

SoFi will then run a young pull in your credit score rating to search out out eligibility and offer you a payment. This gained’t have an effect on your credit score rating the least bit. In case you choose to simply settle for the present and proceed with the mortgage, though, they could additionally conduct a tricky pull (which may current up in your credit score rating report).

Fees

There usually are not any origination or software program expenses with SoFi non-public loans. You moreover gained’t encounter any expenses for prepayment. Which signifies that ought to you choose to repay your mortgage early for any motive, you gained’t be penalized for doing so.

The one expenses you’ll encounter with a SoFi non-public mortgage are your curiosity costs.

Curiosity Fees

As with all loans, charges of curiosity will differ counting on the mortgage requested and your particular person non-public creditworthiness. As of this writing, SoFi’s non-public mortgage charges of curiosity differ from 6.54% to fifteen.49% APR. A discount of 0.25% will also be obtainable for these debtors enrolling in AutoPay.

Your particular person non-public mortgage’s charge of curiosity will depend on:

- The mortgage amount requested

- The reason in your mortgage

- Your non-public credit score rating historic previous

- Your income versus your month-to-month payments (cash flow into)

- Whether or not or not you can have a cosigner

- Your credit score rating score

- The mortgage compensation time interval you request

The upper your credit score rating, the higher your credit score rating score, and the shorter the mortgage compensation you choose, the upper your payment will probably be. Together with a cosigner may even help lower your payment, as can signing up for AutoPay.

Who It’s For

As with all SoFi loans, you’ll have a better chance at approval you most likely have a secure credit score rating historic previous and income.

SoFi candidates are required to have a credit score rating score of not lower than 650, with the standard borrower having a score of 700+. SoFi moreover seems at your cash flow into, versus solely having a look at your income. So that you most likely have extreme payments each month and by no means lots wiggle room in your funds, you may want trouble getting authorised.

SoFi Mortgages

SoFi will not be the first lender you think about when looking for a model new dwelling, nonetheless their mortgage decisions are pretty enticing. For example, chances are you’ll get a home mortgage as a lot as $3,000,000, for as little as 10% down… and, you don’t even have to worry about PMI.

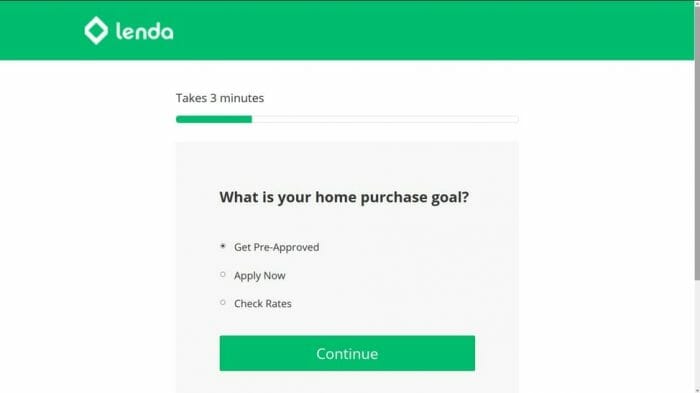

The Utility Course of

Whether or not or not you’re already house-hunting or just have to know what you probably can afford, SoFi might make the making use of course of easy.

You’re going to get pre-approved in your subsequent mortgage on-line in as little as two minutes, with none have an effect on to your credit score rating. SoFi’s easy on-line software program might also offer you expenses and mortgage phrases, so that you notice exactly what you’re having a look at along with your non-public residence purchase

To begin out, go to SoFi’s web page and start a home mortgage software program. You’ll wish to provide your:

- Establish

- E-mail deal with

- State of residence

You’ll even be requested to create a password. That method, you probably can revisit your software program or full the mortgage course of afterward, if wished.

Subsequent, SoFi will ask you in your:

- Deal with

- Cellphone Amount

- Date of begin

- Citizenship standing

- Whether or not or not you rent or private your non-public residence

- Acceptance of SoFi’s phrases

- Coaching data

- Income

- Employment historic previous

The next step is your mortgage eligibility. For this step inside the course of, SoFi must know:

- Whether or not or not you’re looking for a model new dwelling or refinancing your present dwelling

- The property type

- The occupancy

- The place you is perhaps inside the course of

- County and state of the property

- Residence-owner’s dues

- Marital standing

- What you plan to do alongside along with your primary residence

- Number of occupants inside the new dwelling

- Co-applicant data (if related)

While you submit all of this information, you’ll be provided expenses and a pre-approval. You probably can choose the mortgage compensation phrases that almost all enchantment to you, along with your down value need.

This could finish in a young pull in your credit score rating, which gained’t have an effect on your report in any method. Nonetheless, do you have to proceed with the mortgage, SoFi might also conduct a tricky pull, which may current up in your credit score rating report.

Fees

There usually are not any software program or origination expenses involved with SoFi mortgage loans.You moreover gained’t encounter any expenses for mortgage prepayment. Which signifies that when you want to repay your mortgage early, you gained’t be penalized.

The added costs which will very effectively be involved with a SoFi dwelling mortgage embody:

- A down value (as little as 10%)

- Property appraisal

You’ll moreover pay additional expenses for curiosity costs over the lifetime of the mortgage.

Curiosity Fees

As with all mortgages, SoFi charges of curiosity can differ pretty a bit from one applicant to the next. They’re calculated based on fairly a couple of elements, collectively along with your credit score rating historic previous, credit score rating score, income and month-to-month payments, whether or not or not or not you can have a co-signer, your chosen mortgage phrases, your down value, the loan-to-value ratio of your non-public residence, and your employment standing.

Charges of curiosity change frequently. For the time being, though, SoFi affords 15- and 30-year mortgage phrases, along with 7/1 ARMs and 5/1 ARM Curiosity-Solely loans. Fees range from 4.716% to 5.249% APR.

Who It’s For

There are a few good causes to determine on SoFi in your dwelling mortgage, along with a few causes to look elsewhere.

SoFi may very well be a wonderful place to make use of in your subsequent dwelling mortgage when you want to:

- Get pre-approval that doesn’t have an effect on your credit score rating score

- Buy a home with a ticket of as a lot as $3,000,000

- Want the flexibleness of a down value as little as 10%, with out PMI

- Want approval in as little as 2 minutes

- Have a credit score rating score of not lower than 650 (ideally 700+)

- Shut in your new mortgage in decrease than 30 days (on frequent)

Nonetheless, you most likely have a less-than-desirable credit score rating historic previous, have cash flow into points each month or an unstable employment standing, mustn’t a U.S. citizen or eternal resident, or wish to purchase a rental property, SoFi isn’t the place for you.

Mortgage Refinance

To refinance a mortgage by way of SoFi, the making use of course of is the same–you’ll merely choose “refinance my present dwelling” on the third internet web page of the making use of, in its place of “buy a model new dwelling.”

Refinanced mortgages may be discovered to debtors with not lower than 20% equity of their dwelling. Moreover they supply a cashout refinance, when you want to use your non-public residence’s equity for dwelling enhancements, to repay totally different cash owed, or for an enormous purchase.

The Residence of Your Wishes? Make Your Dream Come True With SoFi

Is SoFi Correct for Me?

It would not matter what kind of mortgage you’re looking for, give SoFi a look. You’ll uncover pupil mortgage refinancing, mortgage loans, mortgage refinancing, and even non-public loans–all fee-free. Larger than that, though, chances are you’ll get your expenses and a pre-approval present with out impacting your credit score rating.

SoFi doesn’t have fairly strict pointers regarding borrower’s credit score rating and cash flow into. You’ll have to ensure that you don’t have damaging research in your credit score rating and a score of not lower than 650, though 700+ is correct. Moreover, your income-vs-expenses ratio is way more vital than your income alone, although the standard SoFi borrower has an income of not lower than $100,000.

Fees by way of SoFi are very aggressive and phrases are versatile, offering you loans that meet your needs with out expenses or pointless payments. Plus, the making use of course of takes about two minutes to complete.

Should you want to research further about SoFi merchandise or apply for a mortgage, you’ll be able to achieve this proper right here.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.