What while you abruptly find yourself needing to get your roof repaired and are concerned regarding the APR on a personal mortgage?

Having a fantastic credit score rating ranking implies that you simply’re considered by lenders to be a lot much less harmful, translating into lower costs and the most effective phrases supplied. In actual fact, it’s nonetheless helpful to purchase spherical because you want to ensure you’re getting the most effective bang in your buck.

Listed beneath are our picks for the most effective non-public loans for good credit score rating.

In This Article:

- Biggest Non-public Loans for Good Credit score rating

- What’s Thought-about a Good Credit score rating Ranking?

- What’s a Good APR For a Mortgage?

- Will It Harm My Credit score rating If I Get a Non-public Mortgage?

- How Can I Choose the Biggest Non-public Mortgage?

Biggest Non-public Loans for Good Credit score rating

Biggest mortgage aggregator: Monevo

Biggest for low costs: Lending Membership

Biggest for low costs and educational belongings: SoFi

Biggest for borrowing low portions: EVEN Financial

Biggest for debt consolidation: Prosper

Lender

Min. Credit score rating Ranking

Mortgage Amount

APR Range

Lending Membership 640 $1,000 to $100,000 4% to 36%

Monevo 600 $500 to $100,000 3.49% to 35.99%

SoFi 680 $5,000 to $100,000 5.99% to 21.11% (mounted worth with autopay)

6.99% to 14.70% (variable worth with autopay)

EVEN Financial 580 $1,000 to $100,000 4.99% to 35.99%

Prosper 640 $2,000 to $40,000 6.95% to 35.99%

Monevo

Monevo is a personal mortgage market, offering you with the possibility to test affords from 30+ lenders. Although it favors sincere to fantastic credit score rating scores (600 to 850) they’re saying there are affords all through the spectrum – there’ll merely be fewer in case you’ve poor credit score. Functions use a snug credit score rating study that gained’t harm your ranking (until you proceed with a correct software program) and it’s free to utilize. Monevo is a quick technique to guage affords between quite a lot of lenders immediately. Be taught our full evaluation.

LendingClub

LendingClub is a peer-to-peer lending agency, which implies that it’s not a monetary establishment that lends you money, nonetheless folks. You’re going to get lower costs nonetheless it’s decided by your menace profile, which LendingClub will determine while you fill out an software program. Often you’ll need the subsequent income or a low debt-to-income ratio (how loads debt you’ve taken on as compared along with your income) nonetheless you could file a joint software program. As quickly as your software program is accepted it goes appears on the LendingClub website online so merchants can select to mortgage you money.

SoFi

SoFi affords low costs–though these with elevated incomes are prone to receive them. There will not be any costs, versatile funds and a great deal of educational belongings. Not like many various non-public mortgage lenders, you have received the selection of choosing a set or variable worth mortgage. SoFi moreover has social events, member dinners throughout the U.S. and an web dialogue board the place you could receive career and money advice. Check to see what’s going to work best in your financial state of affairs and browse our full evaluation to review additional.

Even Financial

Even Financial is very similar to Credible in that they’re moreover a mortgage aggregator. It’s possible you’ll qualify for a mortgage for as little as $1,000 and phrases fluctuate from 24 to 48 months. Equivalent to Credible, you fill out one software program variety and it’ll populate quite a few completely totally different lenders that you simply simply may have the ability to qualify for. Be taught our full evaluation proper right here.

Prosper

Prosper affords among the many lowest costs, concentrating on people who want to use a personal mortgage for debt consolidation. It’s possible you’ll study your worth inside minutes on-line (it’s mounted, by the easiest way) and as quickly as accepted, pay it off each in three or 5 years. Plus, there will not be any prepayment penalties so that you simply don’t wish to fret about paying additional costs while you resolve to pay your mortgage off early. Check out our evaluation.

Be taught Additional: A Legit Payday Mortgage Varied? Earnin App Evaluation

What’s Thought-about a Good Credit score rating Ranking?

Credit score rating scores fluctuate from 300 to 850–this suggests the higher your amount, the upper your ranking. In keeping with Experian, considered one of many three essential credit score rating reporting bureaus, 700 is taken under consideration a fantastic credit score rating ranking. Nonetheless, lenders normally moreover take into consideration scores 680 and above as a result of the minimal requirement for an applicant with good credit score rating.

That being said, whether or not or not you’ll be accepted for a personal mortgage may even rely upon elements apart out of your credit score rating ranking which can embody current employment standing.

What’s a Good APR For a Mortgage?

In keeping with information from Experian, 9.41% is the standard charge of curiosity for a personal mortgage. So while you receive a suggestion for a lower worth, then you could take into consideration that good. Perceive that what you’ll qualify for can rely upon points like your financial historic previous and credit score rating ranking.

Will It Harm My Credit score rating If I Get a Non-public Mortgage?

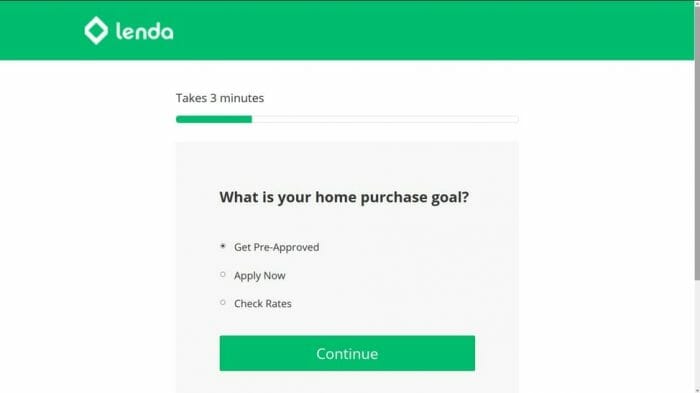

When you’re getting prequalified for a mortgage, your credit score rating ranking gained’t be affected because of the lender is performing what’s known as a snug inquiry. Must you’re procuring spherical, it’s best to hunt out lenders which will try this–usually on-line lenders.

When you fill out an software program variety, that’s when the lender will pull a tricky inquiry which can affect your ranking–it tends to be momentary and your ranking can return up, significantly while you’re a accountable borrower.

Along with, a personal mortgage will assist to increase your ranking since making on-time funds is an enormous situation into how your credit score rating ranking is calculated. Plus, a personal mortgage can enhance your credit score rating mix, which can enhance your ranking as successfully. That being said, don’t take out a personal mortgage solely to try to enhance your credit score rating ranking.

How Can I Choose the Biggest Non-public Mortgage?

Regardless of your credit score rating ranking, you’ll want to retailer spherical, as getting quite a few mortgage affords will allow you to find the most effective worth and phrases. In numerous phrases, it would in all probability allow you to get financial financial savings on curiosity all via the lifetime of the mortgage.

After you’ve quite a few affords, uncover the one with the underside APR as a result of it tends to worth you the least over time. You’ll moreover want to study the phrases of your mortgage. Are there worth reductions while you make automated funds? Is there a flexible price schedule? Will you be penalized while you resolve to repay your mortgage early?

Though not primarily as essential, study to see what totally different perks–suppose financial coaching belongings or free credit score rating ranking monitoring–you’re going to get. Be sure to learn from any perks which will allow you to financially for years to return.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.