Whether or not or not you’re making an attempt to avoid wasting numerous on curiosity on a pupil or a personal mortgage, it might be a ache to purchase spherical for top-of-the-line deal. Nonetheless, attributable to on-line mortgage platforms like Credible, you presumably can consider costs with different lenders all one place–it’s free to utilize.

In This Article:

- What’s Credible?

- How Credible Works

- Making use of for Loans

- Execs and Cons

- Should You Ponder Credible?

What’s Credible?

Credible is a company that provides a market the place you presumably can fill out a single form and allow you consider a variety of lenders immediately. In the mean time Credible gives assist with pupil mortgage refinancing, non-public and private pupil loans.

Yow will uncover aggressive costs via important companies like Residents Monetary establishment and School Ave. The company itself doesn’t straight lend you funds. Fairly it connects you with lenders–it’s free for you because of Credible will receives a commission by the lender you go along with.

Prospects can fill out an utility form with a cosigner (if related) on their site. Credible even helps stroll you through your whole course of.

Candidates should be:

- Not lower than 18 years outdated

- A U.S. citizen or eternal resident

- Haven’t lower than $5,000 in pupil mortgage debt do you have to’re keen about refinancing a mortgage

Whereas Credible doesn’t explicitly state minimal credit score rating requirements, you presumably can safely assume that the upper your score, the higher your chance of getting prequalified for top-of-the-line costs. In every other case, you presumably can apply with a co-signer.

How Credible Works

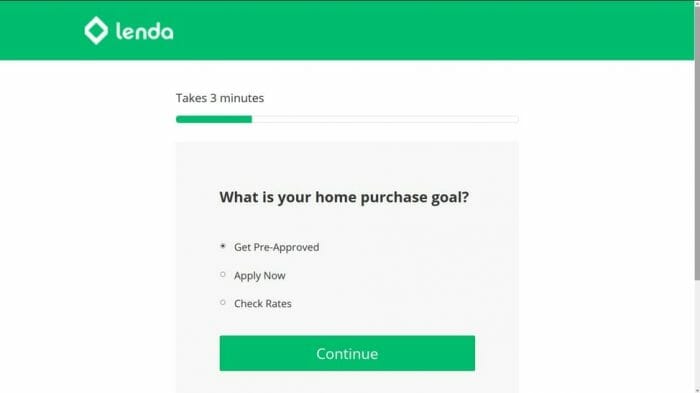

According to Credible, it may presumably take as a lot as two minutes to hunt out your price. Proper right here’s the way in which it really works.

Get a price estimate – Fill out a sort with non-public particulars much like your financial historic previous, the amount you have to borrow or refinance and education historic previous (do you have to’re keen about their pupil mortgage decisions). You’ll be prompted to create a Credible account sooner than persevering with.

Consider decisions – If you full the registration course of, a dashboard will pop up the place you’ll be succesful to see lenders and costs you would possibly be capable of qualify for. You could regulate the filters to slender down or develop your choices counting on what you’re in quest of.

Endure the equipment course of – You’ve completed your evaluation and chosen a particular lender, click on on via to proceed with the equipment. Relying what sort of mortgage you’re refinancing or making use of for, you’ll be requested for numerous documentation much like your current mortgage paperwork and proof of earnings. The lender will then look at your credit score rating to find out whether or not or to not offer you a mortgage. In case you occur to accept their phrases and costs, the lender will contact you on to finalize the availability.

Making use of for Loans

Credible gives a few fully completely different decisions for debtors. Listed below are further particulars about every.

Refinancing Pupil Loans

You would possibly be capable of get financial financial savings by refinancing your loans using Credible–you presumably can take out a model new mortgage with a lower price which will repay your current pupil loans. There are in the meanwhile 10 fully completely different pupil mortgage refinancing lenders on their platform along with iHelp and Rhode Island Pupil Mortgage Authority.

Mounted costs for refinancing starting at 3.99% APR (with AutoPay)* and 1.86% Var. APR (with AutoPay), See Phrases*. Nonetheless, that doesn’t indicate you’ll qualify for these costs–typically these with great credit score rating scores or people who apply with a co-signer that has an outstanding score would possibly qualify.

Personal Pupil Loans

Credible in the meanwhile works with 9 private pupil mortgage lenders that can aid you uncover top-of-the-line costs for private pupil loans. Mounted costs starting at 3.22% APR (with AutoPay)* and 1.76% Var. APR (with AutoPay),*. Just a few of the lenders Credible works with embrace Uncover, Sallie Mae and SoFi.

Sooner than making use of for pupil loans, see what it is potential you will qualify for with federal loans, as filling out the FAFSA may give you much-needed financial assist.

Non-public Loans

Just like pupil loans, you presumably can consider and apply for personal loans within the an identical method with Credible. You would possibly be capable of qualify for personal loans as a lot as $50,000 with costs starting at 4.99% APR (with AutoPay), See Time interval* and as a lot as 11 lenders to pick out from. A non-public mortgage typically is a pleasant choice that can aid you consolidate high-interest debt, like financial institution playing cards.

*Be taught costs and phrases at Credible.com

Execs and Cons

Sooner than using Credible, take into consideration some professionals and cons of the platform.

Execs

Consider costs faster – It could be irritating to go from lender to lender to match costs. That’s why Credible could also be useful–you presumably can retailer spherical all on one platform, saving you time.

A lot much less costs – By shopping for spherical, you’ll be succesful to hopefully save on charges of curiosity and prices when making use of for or refinancing your mortgage.

No impression in your credit score rating score – Credible doesn’t run a troublesome credit score rating look at, which implies that your credit score rating score will not be affected. You’ll solely be matter to 1 while you fill out an utility form with a lender.

Cons

No further federal benefits do you have to refinance – Constructive, refinancing your loans might aid you reduce your charge of curiosity, nevertheless many private loans don’t provide the an identical benefits, like unemployment security and income-based compensation plans. Take a look at to see whether or not or not it’s value it in your state of affairs sooner than switching over.

Not all lenders are represented – Constructive, Credible gives a variety of pupil mortgage and personal mortgage lenders on their platform, nevertheless there are masses further in the marketplace. Which means when you want to retailer spherical and consider costs, it is potential you will wish to go to a few site.

Expenses may not be 100% right – Positive, you’ll be succesful to see costs everytime you prequalify, nevertheless it’s not guide of your remaining provide. In numerous phrases, it’s merely an estimate primarily based totally on the info you current. Which means in case your credit score rating knowledge or completely different parts change by the purpose you submit your utility, your price might very effectively be bigger than initially anticipated.

Should You Ponder Credible?

Credible is a useful platform do you have to’re keen about evaluating private pupil loans, non-public loans and pupil mortgage refinancing. All you need to do is to enter in a single set of knowledge and in addition you’ll be succesful to see a variety of lenders you presumably can go along with. No matter which platform you go along with, make sure you retailer spherical for top-of-the-line costs sooner than signing on the dotted line.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.