Personal loans are fast turning into certainly one of many most popular financing selections. It’s possible you’ll borrow a giant amount of money, finance it over quite a few years with every a tough and quick fee of curiosity and month-to-month payment. You may even use the money for nearly any goal. Essentially the most well-liked is debt consolidation–rolling quite a few high-interest financial institution playing cards proper right into a single, lower worth installment mortgage. Nevertheless you could as nicely use these loans to purchase a car, start a enterprise, make home enhancements, or pay for a wedding, journey, or large, out-of-pocket medical payments.

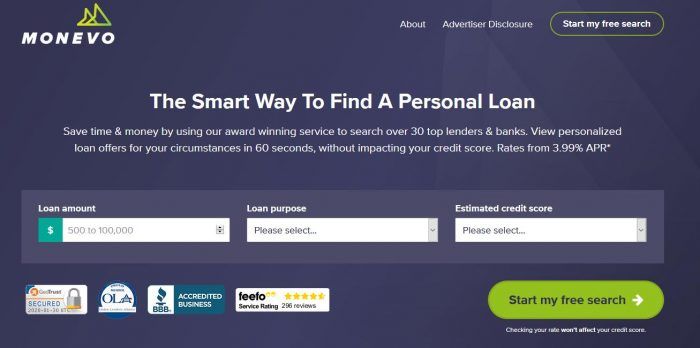

There in the mean time are dozens of on-line companies, banks and credit score rating unions offering non-public loans, all beneath completely completely different phrases. Nevertheless an online primarily based platform like Monevo provides you with a risk to hunt for quite a few non-public mortgage lenders on the similar time. After filling out an online primarily based variety, you presumably can get hold of presents from collaborating lenders. The companies Monevo works with are quite a few the best inside the enterprise.

Monevo locations the power of opponents at your fingertips. In case you occur to’d pretty merely fill out one variety for a personal mortgage and await the lenders to return to you, Monevo is a platform the place you’ll be able to do it.

In This Article:

- Who and What’s Monevo?

- Monevo Mortgage Particulars

- Monevo Choices and Benefits

- Monevo Curiosity Fees and Fees

- The Monevo On-line Course of

- Monevo Execs and Cons

- Monevo Choices

- Monevo Personal Loans FAQs

- Should You Use Monevo to Search for Personal Mortgage Decisions?

Who and What’s Monevo?

With U.S. operations based in San Diego, California, Monevo is an online primarily based non-public mortgage market–a one-stop retailer. The company research participation from higher than 30 lenders and banks, providing mortgage corporations to higher than 250,000 clients each month, funding higher than $1 billion.

And that’s merely from its operations within the US. It’s actually Europe’s largest lending market, with participation from higher than 150 lenders. The company in the mean time operates primarily in Australia, Poland, the U.S. and the UK, funding roughly $10 billion in loans month-to-month.

The company began operations inside the U.S. early in 2017, nevertheless acquired its start inside the UK in 2009.

Monevo has a Larger Enterprise Bureau rating of “A+”, the perfect on a scale of A+ to F. It has been accredited by the Bureau since early 2018.

Monevo Mortgage Particulars

Loans accessible: Personal loans, with mounted fee of curiosity and mortgage phrases, and no collateral required. However, quite a few the collaborating lenders do present completely different sorts of loans.

Minimal/most mortgage portions: $500 to $100,000

Mortgage phrases: 3 months to 144 months (12 years)

Mortgage expenses: No expenses payable to Monevo; see Monevo Curiosity Fees and Fees half beneath for fundamental worth and fee ranges charged by specific individual lenders.

Required credit score rating fluctuate: Truthful to great (credit score rating score of 600 to 850). However, Monevo research selections will be discovered for all credit score rating scores, nevertheless it is best to depend on presents to be a lot much less fairly a couple of you most likely have poor credit score rating.

Mortgage capabilities: Debt consolidation, home enchancment, journey, autos, large purchases, paying off financial institution playing cards, scholar mortgage refinancing (not accessible with all collaborating lenders), education, specific occasions, magnificence procedures, shifting and relocation, household payments, medical and dental payments, taxes, business-related capabilities and completely different makes use of.

Mortgage funds disbursement: The web page signifies you presumably can get hold of your mortgage funds as early as the next enterprise day after approval.

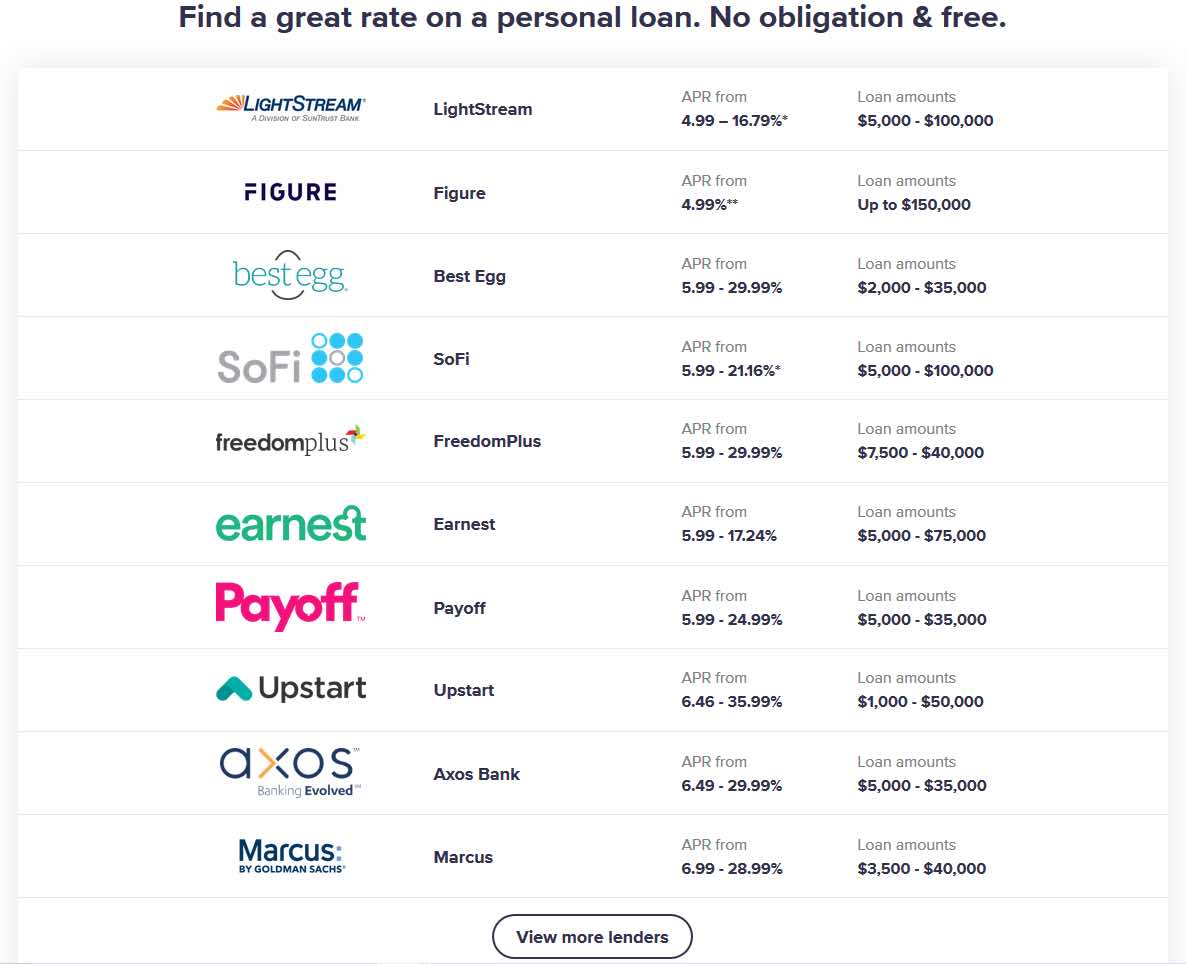

Participating lenders: 30+, along with LightStream, Best Egg, SoFi, Upstart, Marcus by Goldman Sachs, Prosper, Lending Membership, Avant and plenty of others.

Monevo Choices and Benefits

“Tender credit score rating pull”: As soon as you utilize the Monevo service, a cushty credit score rating take a look at is completed, which will not impression your credit score rating score. However, in case you adjust to proceed with a correct utility with any lender collaborating on the net web site, a tricky pull will seemingly be carried out, resulting in a minor unfavorable impression in your credit score rating score.

Course of: On-line variety solely–there’s no risk to utilize the Monevo service over the telephone

Monevo security: The web page makes use of Secure Socket Layer (SSL) encryption experience with the transmission of all delicate information over the Net. As well as they use firewalls to cease exterior entry into their neighborhood. Entry to your non-public information is proscribed to staff, contractors, service suppliers and brokers who need the information to perform, develop or improve the service.

Buyer assist: Contact is on the market by electronic message and reside chat solely. Nevertheless it’s very important to don’t forget that Monevo is only a net primarily based mortgage market and by no means a direct lender. They are going to be unable that will help you with specific factors referring to your mortgage utility with a direct lender.

NOTE: Though Monevo buyer assist is proscribed, you need to use the Monevo service to hunt for a mortgage on a 24/7 basis, and acquire results in beneath 60 seconds.

Monevo Curiosity Fees and Fees

There’s no fee required for using the Monevo web page. The situation earns commissions paid by lenders solely on loans which have been licensed and funded.

Monevo signifies charges of curiosity beginning as little as 3.49% APR to 35.99% APR. The exact fee of curiosity you’ll get hold of will rely in your credit score rating score, the mortgage amount requested, mortgage goal, your debt-to-income ratio, and completely different elements. In addition to, credit score rating evaluation requirements will vary from one lender to a unique.

The precept fee involved in non-public loans is an origination fee. It could normally fluctuate between 1% and 6% of the mortgage amount obtained, and might solely be paid upon disbursement of your mortgage proceeds.

As an example, in case you’re taking a $10,000 mortgage with a 6% origination fee, you’ll get hold of net proceeds of $9,400. This is able to be the $10,000 face amount of the mortgage, minus $600 for the origination fee. You will, in any case, be liable for repaying the entire $10,000 mortgage amount.

Totally different expenses will depend upon the exact lender, nevertheless you normally will not be charged an utility fee or a prepayment penalty in case you repay your mortgage early.

The Monevo On-line Course of

As quickly as as soon as extra, all of the course of takes place on-line. To be eligible, it’s a must to be a U.S. citizen or eternal resident, be a minimal of 18 years of age, and have a sound checking account in your establish.

The strategy begins with pre-qualification. You’ll current three objects of knowledge–the mortgage amount requested, mortgage goal, and your estimated credit score rating score fluctuate.

Then, you’ll get hold of a one-page variety which will request the subsequent information:

- Your full establish

- Date of starting

- E mail deal with

- Fundamental and secondary phone numbers

- Highest education stage achieved

- Level out in case you private your automotive free and clear

- Level out if you need in order so as to add a co-borrower (in that case, that event should present comparable information)

- Your full deal with

- Form of residence

- Month-to-month housing payment

- Time at that deal with

- Employment standing (employed, retired, self-employed, scholar, unemployed)

- Annual gross income

- Your Social Security amount

Whenever you submit your mortgage request, you’ll begin receiving mortgage presents from quite a few lenders inside 60 seconds. However, the web page does warn that they can not guarantee that everyone will get hold of presents.

It’s possible you’ll select the mortgage present that’s most agreeable to you, then full the making use of course of with that lender. In doing so, the lender is susceptible to request further information. This may increasingly embody (nevertheless should not be restricted to) income documentation, repay statements for any loans you want paid off by way of the model new mortgage, earlier employment or residence information, or another information required by the lender.

You’ll be supplied with all phrases and essential paperwork referring to the mortgage you’ve accepted. Funding will occur as early as the next enterprise day, nevertheless does vary by lender.

Monevo Execs and Cons

Execs:

- As an online primarily based non-public mortgage market, Monevo supplies you entry to higher than 30 direct lenders.

- Participating lenders are quite a few the best names inside the non-public mortgage home.

- It’s possible you’ll borrow as so much as $100,000, relating to as a lot as 12 years.

- Mortgage proceeds may very well be accessible as early as the next enterprise day after closing.

- The situation is completely free to utilize, so there’s no worth to you in case you don’t get the mortgage you want.

- Using the Monevo service begins with a cushty credit score rating pull, which will not negatively affect your credit score rating score.

- Monevo has the perfect rating doable from the Larger Enterprise Bureau.

Cons:

- Monevo should not be a direct lender, so they’ll solely be succesful to current restricted assist in utilizing the placement, not for factors with the direct lenders.

- Your financing selections is also restricted you most likely have trustworthy or poor credit score rating.

- Monevo would not present phone contact or the pliability to make use of for a mortgage by phone.

Monevo Choices

It’s easy that on-line non-public mortgage marketplaces like Monevo are certainly one of many finest sources of this sort of financing. Nevertheless in case you need to attempt numerous sources, ponder any of the subsequent:

- Prosper is the second-largest neutral on-line non-public mortgage lender inside the non-public mortgage enterprise. Not like Monevo, they are a direct lender. As certainly one of many enterprise leaders, they supply quite a few essentially the most trendy non-public loans inside the enterprise.

- SoFi is best acknowledged for providing scholar mortgage refinances. Nevertheless they’ve branched out into completely different sorts of financing, along with non-public loans. As a specialised lender, they sometimes need debtors with stronger credit score rating profiles. Nevertheless they’ll even look rigorously at your income, education, and occupation, pretty than relying solely in your credit score rating score.

In case you occur to’re looking out for one different on-line non-public mortgage market, check out Even Financial. They supply comparable non-public loans as Monevo, along with mortgage portions as a lot as $100,000, with charges of curiosity starting as little as 4.99%. Nevertheless don’t be surprised in case you see a lot of the similar lenders collaborating inside the Even Financial web page as you do on Monevo!

Monevo Personal Loans FAQs

? ? Why must I look for a personal mortgage by way of Monevo, pretty than instantly with quite a few non-public mortgage lenders?

As soon as you utilize an online primarily based market like Monevo, you’re inserting numbers to be simply best for you. Pretty than merely inquiring about financing by way of a single lender, your information will seemingly be accessible to 30 or further direct lenders. This will even help you to steer clear of the time and effort spent making use of on to looking quite a few lenders individually. ? ? How come a cushty credit score rating pull gained’t hurt my credit score rating score? If it doesn’t, how environment friendly is it for the lenders?

A snug credit score rating pull is a selected class of credit score rating inquiry. It takes place everytime you pull your particular person credit score rating score, or everytime you authorize a lender or completely different event to make an inquiry. It supplies the lender adequate information to start out the prequalification course of with out having to make a tricky inquiry which will negatively affect your credit score rating score. However, in case you make a correct utility to any lender on the Monevo platform, a tricky credit score rating pull will in the long run be carried out. ? ? Why do I wish to provide checking account information if I’m making use of for a mortgage?

With a view to acquire your mortgage proceeds as early as the next enterprise day, the final word lender you select will desire a checking account to wire the funds into. This information must be geared up at utility so that the wire may very well be carried out immediately. In addition to, many non-public mortgage lenders will current a diminished worth – normally 0.25% – in case you authorize computerized draft funds out of your checking account. It’s a inexpensive payment assortment methodology for the lenders, and additional useful for you since you gained’t have to put in writing down a take a look at every month. ? ? You’ve indicated Monevo can’t guarantee that I’ll get a mortgage approval. Should I be hesitant to utilize the service the least bit?

It’s not solely Monevo which will’t guarantee a mortgage approval. First, Monevo should not be a direct lender and doesn’t have approval authority. Second, approval will seemingly be determined primarily based totally on the collaborating lenders. That approval will seemingly be primarily based totally on fairly a couple of elements, collectively along with your credit score rating score, the soundness of your income, the amount of debt you’re carrying, your debt-to-income ratio, and even the goal of the mortgage you’re taking. Other than non-public loans, nearly no non-government sources can guarantee anyone will seemingly be licensed for financing. That applies to mortgages, personal scholar loans, auto loans, enterprise loans and financial institution playing cards, along with non-public loans.

Should You Use Monevo to Search for Personal Mortgage Decisions?

Personal loans are shortly turning into a most popular financing provide. That’s because of they supply the subsequent advantages:

- They’re totally unsecured–you don’t should pledge any collateral to get financing.

- Every the speed of curiosity and your mortgage time interval are mounted, so your payment will not ever change.

- Since each mortgage has a selected time interval, it can seemingly be paid off on the end of that point interval. That’s totally not like financial institution playing cards, which can proceed for years and years.

- Personal mortgage proceeds will be utilized for nearly any goal.

- Personal loans may very well be an exquisite methodology to consolidate high-interest financial institution card debt, or to amass financing for a enterprise. Small corporations, notably upstarts, have good drawback getting typical enterprise loans.

As helpful and versatile as non-public loans have flip into, an online primarily based non-public mortgage market–like Monevo–is without doubt one of the easiest methods to get one:

- It’s possible you’ll search presents from one in every of higher than 30 non-public mortgage lenders on the platform.

- It’s possible you’ll solicit mortgage presents from quite a few lenders with out affecting your credit score rating score. A troublesome credit score rating pull will solely be carried out in case you choose to associate with a specific lender.

- It’s possible you’ll search from the comfort of your non-public dwelling or workplace–there’s no should go to a lender’s office.

- There’s no worth to utilize the Monevo web page.

- It’s possible you’ll look for a mortgage on a 24/7 basis.

It’s possible you’ll contemplate Monevo as a result of the mortgage equal of going to the mall–as quickly as there, you’ll have many selections to take your company. It could even put the lenders in opponents with one another on your company. And since there’s no fee or credit score rating penalties to go searching pre-qualified mortgage presents, all of the course of is completely risk-free.

In case you occur to’d like further information, or to see your personalized outcomes, go to the Monevo web page.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.