The strategy of getting a mortgage is likely to be horrible. It is necessary to fill out extended capabilities and wait sooner than you even uncover out in case you qualify or not.

And it’s even worse for those who do it particularly individual. As you sit there prepared in your future to be suggested, the mortgage officer meticulously evaluations your credit score rating profile and decides on whether or not or not or to not offer you money.

Ugh.

Nevertheless guess what? There’s a greater technique to get a mortgage:

It’s known as Lendvious.

A play on the phrase envious (I assume because of they make typical lenders envious) Lendvious is a platform that connects you to a variety of lenders who can present you with pre-qualified offers in your mortgage–all at no hazard to your credit score rating score.

On this Lendvious analysis, I’ll share further regarding the agency and the way in which they work to go looking out you the perfect prices doable. From there, you could resolve whether or not or not this “mortgage facilitator” is wise to work with or not. First, let’s be taught further about Lendvious.

In This Article:

- What’s Lendvious?

- The best way it really works

- Key choices

- Who it’s for

- Professionals

- Cons

- Summary

What’s Lendvious?

Lendvious is a mortgage platform, operated by FinMkt, that helps uncover you the underside prices on non-public and debt consolidation loans. If you happen to occur to’re accustomed to SoFi–a corporation that finds you the underside prices on pupil mortgage refinancing–it operates equally. You enter your data proper right into a straightforward on-line sort and Lendvious will present you with a variety of selections to pick out from.

The best way it really works

Lendvious already has partnerships with 15+ lenders, so it’s executed lots of the be simply best for you. Instead of getting to try completely completely different lenders and apply for a mortgage at each one, Lendvious will be part of you to all of them. Proper right here’s the way in which it really works:

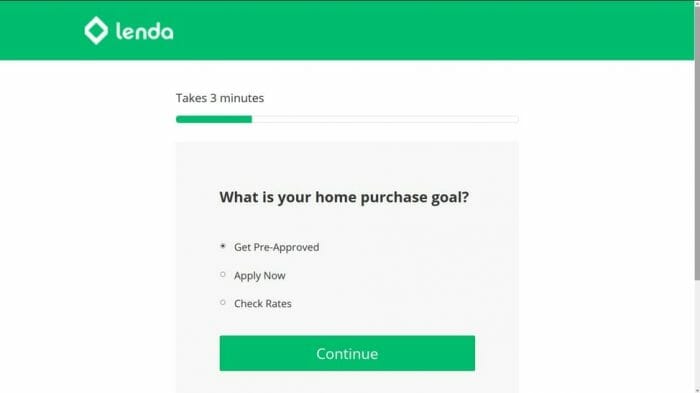

1. Current some main data

Lendvious has a fairly easy on-line sort you fill out. As a solution to get a listing of offers, it is necessary to current them with the following data:

- How rather a lot you’re looking for to borrow (between $1,000 and $50,000)

- What the goal of the money will in all probability be (i.e., financial institution card refinancing)

- How rather a lot debt you at current have

- Your non-public data (i.e., establish, cope with, email correspondence, date of supply)

- Your employment standing and annual income

- Your housing standing (i.e., lease or private)

- Your estimated credit score rating score

- Your social security amount (the situation is protected)

This allows you to view the costs and selections on the market to you. An crucial bear in mind is that it’s a tender pull in your credit score rating and it acquired’t have an effect on your credit score rating score.

2. View your prices

Whenever you’ve submitted the web sort, you’ll be taken to a listing of selections on the market in your mortgage. Take into account, these selections are solely a pre-approval, and are based solely on the data you provided and a young pull of your credit score rating. What that means is that your explicit present might change once you actually apply. If you happen to occur to have been appropriate alongside along with your preliminary data, though, it shouldn’t be too far off.

The fees you’ll receive are from a variety of Lendvious’ companions, and each will fluctuate with the pace and time interval they’re offering. At current, prices start as little as 4.99% and compensation phrases are wherever from 1 to 5 years. Usually, there is no prepayment penalty.

3. Choose your best present

After getting chosen a lender and your mortgage phrases, you could proceed with that specific lender to a full software program. You see, Lendvious works as form of a “middle-man” that connects you with lenders who’re ready to pre-qualify you and at last fund your mortgage.

Usually, you’ll see every kind of selections on the market to you. Some have lower prices than others, nevertheless some even have shorter phrases than others. For example, you can get a mortgage that has a 7.99% worth with a 5-year time interval. This may clearly offer you a lower charge than one factor with a 1-year time interval. Merely don’t forget that everyone’s circumstances will in all probability be completely completely different (i.e., would you want probably the most inexpensive debt or probably the most inexpensive charge?), so it is necessary to pick out the present that works best for you.

4. Get your money

After you select a proposal and fill out a correct software program with that specific lender, you’re going to get your funds in as little as one enterprise day, counting on the lender and mortgage you choose. As quickly as your mortgage is funded, your compensation schedule will kick in and you’ll start using the money nonetheless you deem compulsory.

<< Give Lendvious a Attempt >>

What can I benefit from the money for?

That is possible one of many best choices of Lendvious–because of it has so many companions, your selections are open as to what you need to make the most of the money for. Listed under are some ideas:

- Debt consolidation: If in case you could have high-interest financial institution card debt, you could fund a model new mortgage to consolidate your complete balances into one low month-to-month charge.

- Predominant purchases: Look, ideally, I’d inform you to keep away from losing up for that principal purchase (like a vehicle) nevertheless that’s normally less complicated acknowledged than executed. Inside the cases the place you don’t have cash available, you need to make the most of a mortgage like this to fund a severe purchase.

- Shifting: I merely obtained executed with my second switch in as a number of years, and I can inform you that it really supplies up. Till you’re packing every area your self and shifting it in your vehicle, you’re going to run into some massive payments.

- Enterprise: Guarantee you could have a sound advertising and marketing technique, nevertheless with mortgage portions as a lot as $50,000, you could lastly start the enterprise you’ve on a regular basis wanted to.

- Medical payments: I had a member of the household merely bear a severe surgical process and his insurance coverage protection denied the declare, leaving him with an infinite bill to pay. Sadly, this isn’t uncommon, so if in case you could have some massive medical funds to cowl, a low-interest mortgage is probably helpful.

- Home enchancment: If you happen to occur to don’t must faucet into your personal dwelling’s equity (take into account, that’s secured debt), an unsecured mortgage is an outstanding option to do some residence enhancements with.

- Journey: I don’t personally advocate taking a mortgage out for a visit, nevertheless in case you’re planning an infinite journey, some additional funds may turn into helpful. For example, a family pal not too way back took a cruise to Alaska – and let’s merely say a go to like that is NOT low-cost.

- Taxes: Whether or not or not you’re employed or have your private enterprise, typically taxes can shock you. My first 12 months of getting my very personal enterprise obtained right here with a bit little bit of a sticker shock. I was prepared for it, nevertheless I can understand the way in which you’ll not be–by way of which case a low-interest mortgage can cowl you.

Key choices

You is probably questioning why you must seize a mortgage by the use of Lendvious versus going to your native credit score rating union. Listed under are among the many key choices which can help help your alternative:

1. A single platform with entry to quite a few lenders

High-of-the-line parts of a service like Lendvious is entry to quite a few lenders by merely using one on-line software program. In another case, it is necessary to retailer spherical and submit capabilities at completely completely different lenders merely to get an considered what you’d qualify for. Lendvious not solely connects you to quite a few lenders nevertheless will get you pre-qualified offers inside minutes, so you may as well make in all probability probably the most educated alternative on which mortgage, if any, to resolve on.

2. Speedy pre-qualification

Gone are the instances of creating use of for a mortgage and prepared for an email correspondence (or worse – a letter inside the mail) to tell you whether or not or not or not you’re licensed for the mortgage. Lendvious takes a handful of information and turns it into pre-qualified offers by the use of a variety of lenders–all at your fingertips. It’s good, too, because of this has no have an effect on in your credit score rating score and it allows you to take the perfect present on the market for you, or no present the least bit.

3. Fast entry to money

As quickly as you progress forward from a pre-qualified present and finish an software program with a certain lender, you’ll have your funds in as little as sometime upon approval. That’s extraordinarily fast. Now don’t forget that this relies upon your lender and mortgage measurement, along with a few completely different parts, nevertheless to know which you may get money this shortly is a blessing–as everybody is aware of that getting a mortgage isn’t on a regular basis a proactive alternative. Inside the case of points like taxes or medical funds, typically the need for a lump sum of cash is sudden (and you must on a regular basis avoid payday loans).

Who it’s for

Lendvious is principally for anyone who’s seeking a non-public mortgage to cowl some type of debt or principal expense. Whether or not or not you’re remodeling your personal dwelling, consolidating financial institution card debt, or paying for a go to to the Maldives, you need to make the most of Lendvious as a platform to find mortgage selections. The nicest half about it is which you’ll “dip your toe inside the water” by seeing pre-qualified offers sooner than shifting forward with any type of full software program (or to proceed the metaphor, leaping into the deep end of the pool). That’s what makes it for everyone–because of not all people will uncover a mortgage that matches them, and there’s really no hazard in checking it out.

Professionals

- Fast and easy on-line software program system

- Affords from a variety of lenders

- Prices as little as 4.99%

- No-risk to find pre-qualifying offers

- Entry to money as quickly as accepted could possibly be very fast

Cons

- Not all people will qualify, or qualify for the underside prices

- Counting on the mortgage measurement, even a five-year time interval (their most) creates too big of a charge

- Prices normally are usually not as aggressive as some introductory and/or steadiness swap financial institution card offers

- A model new mortgage being created will set off a troublesome pull in your credit score rating, impacting your score

<< Look at Financing Affords With Lendvious Now >>

Summary

Lendvious is an outstanding alternative for anyone seeking a mortgage because of its easy software program course of and the wide selection of selections it presents to most debtors. That’s all on a pre-qualified basis, so that you just’re able to see mortgage prices with out having any have an effect on in your credit score rating score. At the moment, in case you resolve to maneuver forward you could fund a mortgage and get your money in as little as a day.

Don’t forget that Lendvious doesn’t fund loans themselves, nevertheless reasonably they perform the connector between you and 15+ completely completely different lenders. If you happen to occur to’re accessible out there for any type of mortgage, as a lot as $50,0000, I would advocate a minimal of giving Lendvious a shot.

,

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.