finance on calculator.

finance on calculator.

Please be happy to make use of this picture that I’ve created in your web site or weblog. For those who do, I would drastically respect a hyperlink again to my weblog because the supply: CreditDebitPro.com

rrExample:

Picture by Credit score Rating Information

r

rThanks!

rMike Lawrence

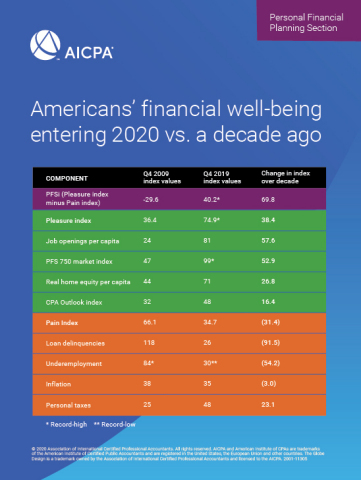

Individuals are extra happy than ever about their private funds, in keeping with a quarterly report by the American Institute of CPAs (AICPA).

The institute’s Private Monetary Satisfaction index reached an all-time excessive of 40.2 within the fourth-quarter of 2019, after plummeting to a document low within the prior quarter.

Private Finance Satisfaction Pushed by Inventory Market

The gauge measures the private finance standing of a typical American and was principally pushed by a surge within the inventory market within the final quarter, the institute mentioned.

“The inventory market’s efficiency during the last decade is an ideal instance of why it’s essential to stay centered on the long-term objectives of your monetary plan,” Dave Stolz, chair of the American Institute of CPAs’ PFS Credential Committee, mentioned in an announcement.

Job openings and underemployment additionally had a huge impact on the index. Underemployment was at an all-time excessive in 2009 and now could be at an all-time low of 6.9%, as the general U.S. financial system has strengthened over the previous decade. The variety of mortgage delinquencies additionally dropped, indicating that extra Individuals really feel financially safe sufficient to repay their loans.

The one issue that didn’t enhance during the last decade was private taxes, which has doubled from 2010, when taxes have been low on account of an financial stimulus bundle, AICPA acknowledged.

Monetary classes from the final decade

General, the monetary state of affairs for Individuals is extra constructive than it was ten years in the past, when the U.S. was nonetheless recovering from the Nice Recession. The index measured a adverse 29.6 because of enormous rises in unemployment and mortgage defaults within the fourth-quarter of 2009.

Job openings during the last decade rose 204%, from 2.4 million in 2009 to 7.4 million, making an enormous distinction within the monetary well-being of Individuals. In the meantime the PFS 750 Market index, which measures 750 of the biggest corporations buying and selling on Wall Avenue, skilled its longest bull run in historical past. The inventory index rose 162% from a complete worth of $13 trillion to $34 trillion.

Michael Landsberg, member of the AICPA Private Monetary Planning Government Committee mentioned in an announcement that whereas it was encouraging that so many Individuals have continued to maintain up mortgage funds, they need to hold the teachings of the previous decade in thoughts.

“That is the proper time to evaluation all of your debt obligations and just be sure you’re not overextended. By taking time to strengthen your monetary home now, whereas financial circumstances are favorable, you’ll be in a greater place to experience out the following recession,” he mentioned.

How the index is calculated

The quarterly index is calculated as a Pleasure Index minus a Ache Index. Every of those sub-indexes are composed of equally weighted financial elements. The Pleasure Index measures alternatives and progress, whereas the Ache Index measures taxes, inflation, and mortgage delinquencies. A constructive studying means the common American must be feeling much less monetary stress and be constructive about their general monetary state of affairs.

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.