Interview with Jan founding father of coinlend.org

What does coinlend.org do?

The massive cryptocurrency exchanges present P2P margin funding to fund the leveraged positions of margin merchants. Customers can lend out their cryptocurrency or fiat holdings and can retrieve curiosity for his or her loans. The rates of interest are often very excessive but additionally very unstable. This yr the typical rate of interest has been ~29% for Bitcoin and ~26% for the US-Greenback. The issues for the person in utilizing the margin funding are the next:

The interface of Poloniex and Bitfinex is sophisticated and cluttered. New customers are often daunted by the interface and wish a information to create their first margin loans.

Creating loans for various currencies on totally different platforms is time-consuming.

Jan Founding father of Coinlend

Jan Founding father of Coinlend

As a lot of the loans have a length of two days and will be repaid by the borrower at any time, the lender has to test his account repeatedly to resume the loans.

The person has to investigate the lending ebook to decide on an excellent rate of interest for the present market scenario.

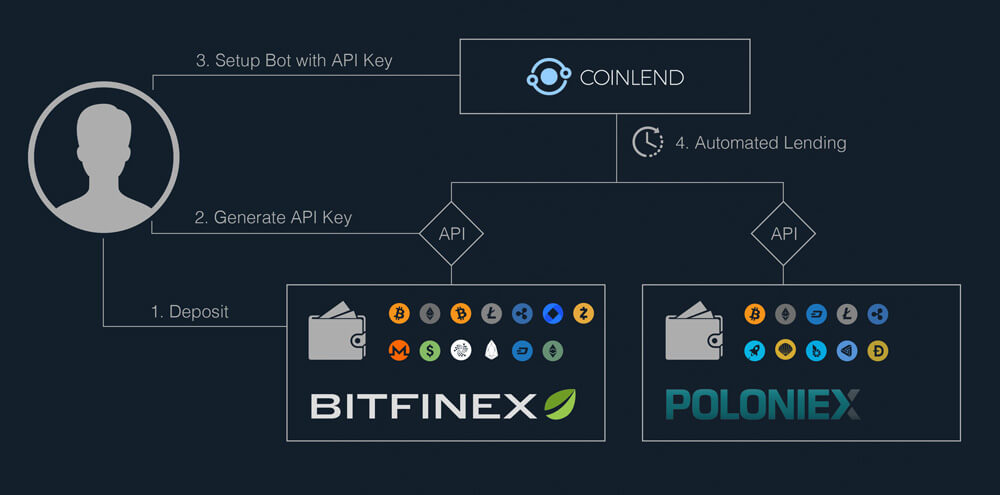

Coinlend is a service to automate the margin funding course of fully and to generate the utmost curiosity on the crypto and fiat foreign money holdings for a person.

What are the origins of this undertaking?

Some pals and I began lending cryptocurrencies again in 2013. We did it manually for a very long time, however in some unspecified time in the future realized, that now we have to dedicate lots of time to lending if we need to generate an excellent return on funding. So we began to code a easy program to automate the method utilizing the API of the exchanges. At first, it was only a native program so that you needed to run it in your native machine or in your non-public server.

Later we created a web-based model of it to make it accessible for some extra pals. It nonetheless had no person interface however was purposeful and environment friendly. We began to comprehend there’s a enormous demand for it. So we created a pleasant person interface for it and determined to make it accessible for the general public starting of this yr.

What are the benefits of utilizing coinlend.org over lending manually?

Lending manually could be very time-consuming. Loans have a length of 2-60 days at Poloniex and 2-30 days at Bitfinex and the borrower will pay again the mortgage at any time. So a lot of the loans have a length lower than 2 days. Typically loans are even paid again after minutes or seconds.

So to optimize your ROI, you must be logged in to the exchanges 24/7 and renew your loans as quickly as they’re paid again. You should utilize the auto-renew performance of the change, but it surely renews the loans with the identical rate of interest as final time. For the reason that rates of interest are very unstable, the auto-renew operate will both lend at an rate of interest too low and you’ll miss out on curiosity or the rate of interest is simply too excessive and no borrower will take the mortgage.

Coinlend solves these issues: As soon as arrange, it runs 24/7, calculates the optimum charges and creates new loans each couple of minutes.

What lending methods does coinlend.org use?

Coinlend does analyze the present lending ebook, filters out the outliers and calculates the optimum rate of interest based mostly on a number of parameters that are continuously evaluated and up to date. The algorithm additionally evaluates the lending charges of the latest historical past to stop low rates of interest on brief dips.

The mortgage length is calculated based mostly on the present rate of interest in comparison with common rates of interest. So if the present rate of interest is excessive in comparison with the typical charges, it should lend for longer durations to protect these rates of interest for an extended time.

The person can fully depend on the Coinlend algorithm or he can modify some parameters just like the minimal rate of interest or when the loans are created for what length.

For the superior customers, there are additionally some superior options just like the “iceberg technique” which is able to cut up funds into many smaller loans over time.

How can a brand new person begin utilizing Coinlend? How lengthy does it take?

Our predominant focus was to make the setup of the bot so simple as attainable. At Coinlend the person solely must fill out two enter fields: API key and API secret and save them. That’s it. Coinlend will take over the remaining and can begin lending the person funds.

How the API Credentials are created on the exchanges is described in each element in our step-by-step guides:

- https://www.coinlend.org/#!PoloSetup

- https://www.coinlend.org/#!BitfinexSetup

So a person completely new to the subject ought to be capable to end the setup in a few minutes.

What are the principle variations between lending on Poloniex, BitFinex and Quinone?

They’re mainly all working the identical means. Simply the person interfaces and rates of interest differ a bit. If the person makes use of Coinlend, he may have a unified interface for all of them.

Have you learnt of different platforms that supply curiosity or passive revenue from coin lending?

Apart from Poloniex and Bitfinex, there may be Quoine and BitMEX.

What ought to buyers look out for when deciding on a cryptocurrency lending robotic?

Most necessary options are the connection intervals to the exchanges and the reliability of the lending executions. Our service is working on the Google Cloud and might spawn new cases on demand and due to this fact we’re assured in having essentially the most sturdy and quick lending service.

What are the dangers of utilizing coinlend.org?

There isn’t any threat in any respect in utilizing Coinlend. We retailer the API credentials at Coinlend encrypted and solely accessible from the backend. And even when a hacker might get entry to the API credentials, he couldn’t do any hurt to the customers. When creating the API credentials the person has to pick the permissions assigned to the credentials. Coinlend doesn’t want withdrawal nor buying and selling permission and the platform will reject credentials which do present these permissions.

What are the dangers associated of on an change?

I see the next two dangers:

- An enormous hack or a legislation enforcement takedown of the change. Bitfinex was hacked final yr and $80 million of person funds had been stolen. Bitfinex paid again the stolen funds to their customers out of their very own pockets.

- A really huge and quick value motion of a coin, so that there’s not sufficient liquidity to shut leveraged positions in time. This by no means occurred up to now.

Are there methods to cut back this threat?

An strategy to attenuate the chance is to distribute the funds throughout a number of platforms. So if one of many platforms disappears for no matter motive, not every thing is misplaced.

What’s your value construction? Do you intend to alter it within the close to future?

Presently, Coinlend is financed by donations. For the reason that person base is rising quickly and the donations barely cowl the server prices, we’re planning to introduce a premium function. Premium options will get extra options like detailed tax reporting.

Do you intend so as to add new options?

We’re actively growing new options. The options that are requested essentially the most and due to this fact are on high of our TODO listing are:

- Implementation of extra Exchanges (Quoine, BitMex)

- Curiosity stories which can be utilized for tax declarations

- Extra info on the generated curiosity (present curiosity generated on particular days and customized durations)

That are your favorite high three altcoins immediately?

- Waves -> Decentral change with fiat gateways

- BAT -> Privateness, safe and ad-free browser

- Byteball -> Tangle expertise, good contracts and truthful distribution (at present 10% month-to-month “dividends” throughout distribution section)

For extra info please go to: http://www.coinlend.org

We thank Jan for the interview.

About

For most people, navigating words like financial loans can be challenging. There are so many temptations out there that it can be hard to live a financially balanced life. Our focus is on helping you discover your path to financial success.